Investment Strategy Insights: Are Profit Prospects Dimming?

Michael J. Kelly, CFA

Global Head of Multi-Asset

It appears that price increases have been good for corporate profits. Driven by Covid-related supply bottlenecks and abetted by helicopter money as fiscal and monetary authorities acted in concert, soaring prices have helped push S&P 500 earnings per share 23% above trend, based on our Multi-Asset team’s estimates. This differs from the 1970s experience, when that bout with inflation did not spike profits. But might the decoupling and unwinding of all these strange bedfellows reduce pricing power and demand faster than it does cost pressures – potentially resulting in a profit recession, even absent an outright economic recession?

While second-quarter numbers are still being tallied, it appears that sales were still up roughly 12%, with earnings up “only” 9.5%, an early warning sign of building margin pressure. Meanwhile, goods deflation is unfolding quickly, driving down headline inflation in a rapid, albeit transitory manner, obfuscating the secular risk of tight labor markets threatening to drive wage pressures higher. Wage pressures above productivity drive core service inflation, which is pivotal given the dominance of today’s service economy and the collapse of productivity this year.

No wonder frigid Wyoming winds blew over Jackson Hole in late August, reminding investors that the Fed put is a thing of the past. In his brief remarks, Chair Jerome Powell finally told the world in unambiguous terms that the Fed is committed to dampening demand to match the current level of constrained supply, whatever the cause, to tamp inflation. This is critical as we transition from a decade of insufficient demand to a potential era of insufficient supply. The Fed intends to hike and then hold rates at higher levels than today even if households, businesses, and investors feel the pain. For the first time, Chair Powell may have revealed his desire to put his stake in the ground by channeling Volcker, Greenspan, and Bernanke while omitting Yellen, who launched “QE forever” while collaborating with him to bring one version of Modern Monetary Theory (MMT) to life in the wake of the Covid crisis.

Investors not only listened, but heard, and quickly got cold feet and fled. Imagine a world driven primarily by fundamentals, and no longer by central bank largesse? Given the wide range of possible recessionary outcomes with no Fed put on offer, their stampede to the exits is a nod to the new environment ahead.

One indication of what could unfold came on the same day as the Fed chair’s market-shaking speech. The Commerce Department released its latest Personal Consumption Expenditure (PCE) number – the Fed’s preferred inflation measure – which showed a drop in July to an annual rate of 6.3%, largely due to lower energy prices, while core PCE, which excludes food and energy (but includes “transitory goods deflation”) fell to 4.6%. Markets continued their slide.

So far, this cooling of still-hot inflation appears to be less the result of the housing market cracking, supply chains easing, inventories rationalizing, and demand for goods falling (even while services rise); it may speak more to both monetary and fiscal authorities recognizing that they too played a significant role in nurturing inflation. The “hike and hold” focus on policy rates will soon give way to the onset of quantitative tightening (QT). Jackson Hole is now behind us. Profits and liquidity resetting lower in tandem may lie ahead.

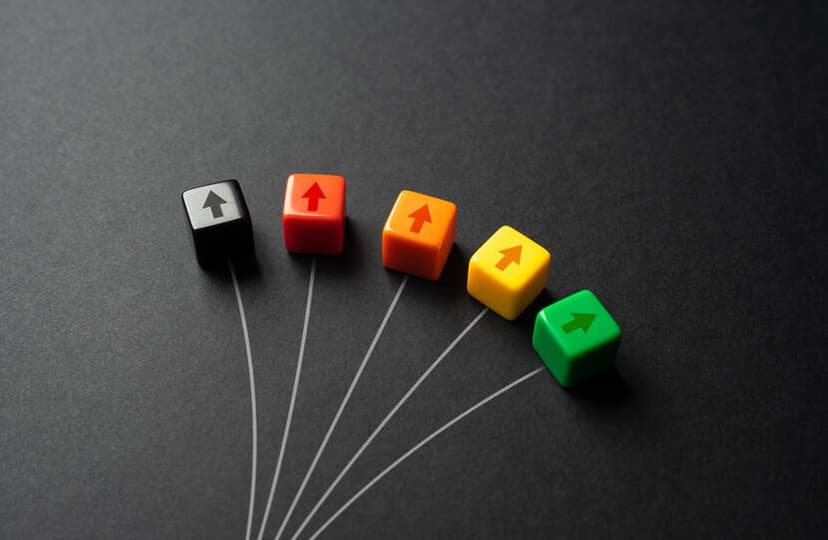

Conviction Score (CS) and Investment Views

The Conviction Scores shown below reflect the investment team’s views on how portfolios should be positioned for the next six to nine months. 1=bullish, 5=bearish, and the change from the prior month is indicated in parentheses.

Global Economy

Markus Schomer, CFA Chief Economist, Global Economic Strategy

CS 3.25 (unchanged)

Stance: We kept our Global Macro score unchanged with its moderately bearish tilt. While the tough talk coming from Jackson Hole slapped the equity market and could indicate a greater likelihood of tightening excess, it’s also possible that steadily declining US inflation could do the Fed’s job and lead to much lower rate expectations for next year. That would remove Fed policy error as a potential recession source. Slowing inflation also could translate into real income growth if tight labor supply keeps wage growth elevated. That should allow consumption to rebound and remove a second recession source. Our European CS remains at 4 given the continued upsurge in inflation and the continued deterioration in its economy’s vital signs. The upcoming Italian elections also mean elevated political risk. My China CS remains at 2.75; the weaker near-term data flow is already stepping up the policy response, which should deliver better growth in 12 months’ time. Finally, emerging markets (EM) PMIs have proven quite resilient despite substantial policy tightening, but protracted inflation and the strong US dollar are keeping my EM CS at 3.25.

Outlook: Our base case remains “Slowdown, no Recession.” Absent a gas shock in Europe, we expect global GDP growth to remain weak this year, but with prospects improving during 2023 if inflation slows more noticeably everywhere, which would allow real wage growth to rebound and could prompt rate cuts starting in some EM economies.

Risks: 1) Escalating geopolitical crises, 2) Central bank policy errors in the form of excessive tightening, and 3) Normalization in labor demand, marking an end to the tightly-packed economy

Rates

Gunter Seeger, CFA Portfolio Manager, Developed Markets Investment Grade

CS 2.75 (-0.75)

The Federal Reserve’s confusing rhetoric – trying to show resolve in fighting inflation while not riling the market – is adding to volatility in an already illiquid market and weakening the government’s creaky credibility. As a result, our base case continues: The Fed puts on a brave face, but ultimately pivots to stop the recession. The market acts as if that has already happened. Since Fed Chair Jerome Powell’s comment on 27 July that the neutral rate is 2.25% to 2.5%, which the market interpreted as a pivot that placed the Fed “put” back on the table, Fed funds futures have dropped 25 basis points (bps), Eurodollar futures have declined, the Nasdaq Index shot up 14% in 15 days, and the five- and 10-year breakevens in TIPS have improved, signaling higher inflation. The burden of proof now falls squarely on the Fed to demonstrate its inflation-fighting determination. More waffling will be translated into inaction. Currently, the 20-year part of the curve looks most attractive, followed by the seven-year. The 10- and 30-years appear rich.

Credit

Steven Oh, CFA Global Head of Credit and Fixed Income

CS 3.75 (+0.50)

August’s continuing positive market tone has extended to the point where valuations do not reflect the myriad of downside risks. Therefore, it is prudent to use the current market rally, particularly in assets below investment grade (IG), to reduce portfolio risk and become more defensive once again. With the very strong rally in high yield (HY) that recently has been testing +400 levels, we have reversed our prior preference for HY over IG and currently believe the differential is too tight given a slowing global macro environment. Our defensive bias now favors IG credit, and we continue to prefer US over the rest of the world. While we would agree that the Fed will be slowing its pace of rate hikes, the market’s pricing of easing in 2023 is misguided. We believe there will be a much higher hurdle for any easing, creating conditions that call for risk aversion.

Currency (USD Perspective)

Joey Cuthbertson, CFA EM Sovereign Analyst, Fixed Income

CS 2.00 (-1.00)

The eurozone’s return to positive interest rates, a lower US Consumer Price Index (CPI) print, and stronger US employment numbers have prompted some unwinding of US dollar longs in illiquid foreign exchange (FX) markets. Critical for US dollar bulls, the euro has failed to break above the key technical level of 1.035, keeping our long US dollar as “best house on a bad street” thesis intact. We believe that as winter approaches, Europe’s higher energy costs will lead to lower growth, energy rationing, and reduced employment, all tying the hands of a hawkish European Central Bank and pushing the euro to 0.9300. The eurozone’s sticky inflation path will keep European real yields lower than those of the US, which will see a quicker fall in its inflation. The bad news for the British pound is mounting too. The Bank of England’s (BOE) August meeting delivered the frightful combination of a 50-bp hike and a five-quarter recession forecast. This reaffirms that the BOE has limited room to hike, compounding Britain’s persistent and worsening current account, which will need financing from a further weakening pound.

In Japan, the waning impact of the terms-of-trade shock removes one of the factors that drove the Japanese yen to its 24-year low. We maintain our 12-month forecast of 147 based on the dovishness of the Bank of Japan. However, we acknowledge that the Japanese yen is undervalued according to most long-term valuation models, making the euro the likely new funder for investors willing to remain long the US dollar.

Emerging Markets Fixed Income

Chris Perryman Senior Vice President, Corporate Portfolio Manager and Head of Trading, Emerging Markets Fixed Income

USD EM (Sovereign and Corp.)

CS 3.00 (-0.50)

Local Markets (Sovereign)

CS 3.00 (unchanged)

With markets focused on how the US Federal Reserve will proceed with its tightening, we’re keeping our global macro scenario weights unchanged, firmly in the global recession camp. The economic outlook has hardly changed since June despite the Powell pivot and market relief rally. At that time, we reduced the probability of our “Cruise Along” scenario to 30%, increasing our “Bear-on-a-Leash” outlook to 40% and our “Armageddon” probability to 30%. We improved our score on US dollar emerging market debt due to a decline in rate volatility and better technical market conditions. While coming off a high base, which is why we are more neutral, the fundamental picture for EM remains reasonable with pockets of positive outlooks. We maintain a defensive approach, favoring higher-quality names with selective HY exposure.

Multi-Asset

Peter Hu Senior Vice President, Portfolio Manager, Global Multi-Asset

CS 3.50 (unchanged)

With the reopening behind us and no longer buffering a slowdown, we maintain our cautious score. Most concerning is wage growth data. Although average hourly earnings are slowing, more accurate measures of wage growth, such as the Atlanta Fed’s Wage Growth Tracker and the Employment Cost Index, continue to accelerate. We now fear that tighter financial conditions are still required. From a bottom-up perspective, the overall message is shaping up as slow deterioration in current-quarter earnings and downgrades of 2023 expectations. For now, the erosion is slow and the market has taken heart from better-than-feared results. Overall, we see a looming GDP growth scare with an earnings recession. While the Fed is likely to stop hiking at 3.25%, quantitative tightening will be notched up in September. The tightening is likely to be long-lasting with sticky inflation unless we get into a deep recession.

Global Equity

Ken Ruskin, CFA Senior Vice President, Senior Research Analyst and Head of Sustainable Investing- Equities

CS 2.50 (unchanged)

The market is in a constant debate about the durability of inflation and the monetary response. In the past month we’ve seen increasing signs that non-labor inflationary pressures are easing, which has made the market more hopeful that a soft landing can be achieved. Second-quarter earnings reports so far are showing that companies have generally been able to navigate the complex environment well. It appears that pricing power remains robust across most end markets, and supply chain pressures are easing on the margin. Guidance has remained conservative given ongoing uncertainties. The market weakness presented us with opportunities to upgrade the portfolio and invest in companies that are typically richly valued. As always, portfolio style balance remains a key component of our risk management.

Global Emerging Markets Equity

Taras Shumelda Senior Vice President, Portfolio Manager, Global Equities

CS 2.25 (unchanged)

In China, July industrial output rose 3.5% year over year, which lagged forecasts but constituted the third consecutive month of acceleration. Zero-Covid policy remains a headwind and is causing an uneven recovery. In India, most consumer companies increased prices to offset cost pressures. Balance sheets of companies are robust, with low debt levels, while banks have cleaned up bad loans such that their balance sheets now sport the healthiest net nonperforming asset (NPA) ratios in a long time. Strong earnings at portfolio companies have improved the outlook for Latin America, where some of investors’ biggest macro and political fears have not come to pass. Uncertainty prevails in Central and Eastern Europe, but that is reflected in asset prices. It is too early to predict the path of the conflict in Ukraine, which has lost some of its recent intensity, but it’s noteworthy that more cargo ships are leaving port due to the grain export deal. We remain of the view that long-term opportunities in global EM are some of the best that we have seen in years.

Quantitative Fixed Income

Qian Yang Vice President, Fixed Income Quantitative Strategist

Our US Market Cycle Indicator (MCI) deteriorated to the risk-off zone at 4.03, with a flatter curve (at -28 bps) outweighing tighter BBB credit spread (at -10 bps). The Global Corporate Model remains positive on EM and negative on developed markets (DM), where it favors energy, natural gas, electric, and utilities, and dislikes financials, brokerage, and basic industry. In EM countries, the model favors Israel, India, Argentina, Indonesia, and South Africa and dislikes Hungary, Colombia, Turkey, Chile, and Thailand. Among EM industries, the model likes oil and gas, and pulp and paper. It dislikes real estate, metals, and transportation. The Global Rates Model continues to forecast a lower yield and a flatter curve. In the G10 Model Portfolio, the rates view expressed is overweight global duration. It is also overweight North America, underweight Europe (where it is overweight peripheral countries and underweight core countries), slightly overweight Australia/ New Zealand, and slightly overweight Japan.

Disclosure

Investing involves risk, including possible loss of principal. The information presented herein is for illustrative purposes only and should not be considered reflective of any particular security, strategy, or investment product. It represents a general assessment of the markets at a specific time and is not a guarantee of future performance results or market movement. This material does not constitute investment, financial, legal, tax, or other advice; investment research or a product of any research department; an offer to sell, or the solicitation of an offer to purchase any security or interest in a fund; or a recommendation for any investment product or strategy. PineBridge Investments is not soliciting or recommending any action based on information in this document. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of PineBridge Investments, and are only for general informational purposes as of the date indicated. Views may be based on third-party data that has not been independently verified. PineBridge Investments does not approve of or endorse any republication of this material. You are solely responsible for deciding whether any investment product or strategy is appropriate for you based upon your investment goals, financial situation and tolerance for risk.