Select your geography

Americas

China Beyond Evergrande: Contagion or Containment?

Arthur Lau, CFA

Co-Head of Emerging Markets Fixed Income, Head of Asia ex Japan Fixed Income

Andy Suen CFA, FRM

Co-Head of Asia ex-Japan Fixed Income

Fan Zhang, CFA

Portfolio Manager & Credit Analyst, Fixed Income

The global spotlight is focused sharply on China right now. While the fallout from Evergrande’s looming credit event will be widely felt across global financial markets in the coming months, there is a bigger question confronting investors: what’s the future of China’s fixed income market?

Evergrande is not the first case of a debt debacle in China; earlier this year, China Huarong, a state-owned enterprise, needed a government bailout after a near-US$16 billion loss.1 However, the difference with Evergrande is twofold: first, it is more entrenched in the Chinese economy; and second, it is less likely to get direct government support.

Despite Evergrande's seemingly “too big to fail” scale, we expect Beijing to resolve the debt woes by prioritizing an orderly restructuring of the company, instead of offering direct support.

Inevitably, there will be some financial pain for bondholders in the short term, coupled with dented confidence within the international investment community. Longer term, however, it shouldn’t deter investors from capitalizing on benefits such as yield and diversification that China fixed income can offer global portfolios – via selective exposure based on the right research.

Will there be systemic risk?

The unprecedented scale and complexity of the Evergrande situation will take its toll over the coming months.

Until a more concrete government action plan emerges, we expect the company’s size and linkages within China’s economy to exert continued pressure on financial markets. A higher systemic risk premium will be built-in: what nobody knows is, just how much.

Yet we believe authorities can and will intervene to prevent spillovers into the broader property market and, therefore, the wider financial system. This is based on our view that the government has sufficient policy tools to minimize the impact. It has demonstrated these in how it has handled a number of large-scale defaults (for example, Baoshang Bank, HNA, and China Fortune Land Group), controlling the associated contagion risks.

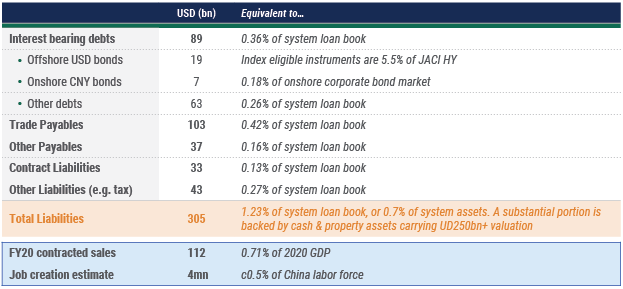

Evergrande is big, but the Chinese authorities can mitigate the systemic risks

Source: Company report, CBIRC, PineBridge estimates as of 24 September 2021. For illustrative purposes only. We are not soliciting or recommending any action based on this material. Any opinions, projections, estimates, forecasts, and forward-looking statements presented herein are valid only as of the date of this presentation and are subject to change.

Looking more closely at Evergrande’s debt profile should provide some clarity – as well as reality – in terms of how it can be managed to avoid any long-term concerns among global investors.

For example, the company’s total interest-bearing debts amount to approximately 0.36% of total banking system loans. And even if trade payables are included as debts, they account for less than 1% of the banking system’s loans. Also, a substantial portion of the onshore borrowings are backed by Evergrande’s property assets, which represent US$250 billion-plus value on its balance sheet.

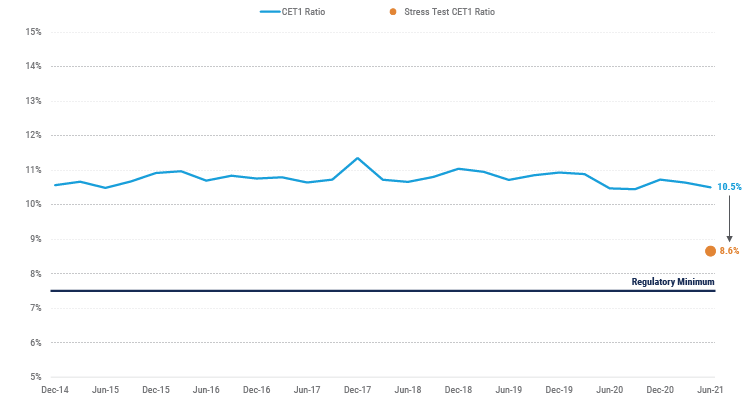

As a result, the actual credit loss for lenders will be even smaller than the above percentages. Further, with the banking system CET1 ratio at 10.5% and loan provision ratio at 3.4%, we think the loss associated with direct Evergrande exposure is very manageable, although some banks, such as smaller regional banks, may have relatively larger exposures to the company.

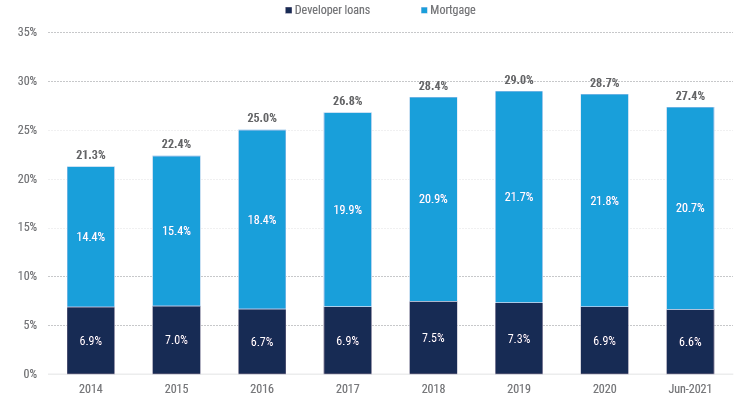

In view of the potential deceleration of China’s housing market, we also believe that far-reaching fears about the extent of the direct exposure within China’s bank system to the property sector are overstated. As of first-half 2021, for instance, the banking sector had 27.4% of loan exposure to real estate (down from a peak of 29% at end-2019). This was split into 6.6% to developers and 20.7% to mortgages. Notably, the mortgage non-performing loan (NPL) ratio has stood at below 0.5% since 2010, and we believe asset quality will stay healthy. In addition, with the average loan-to-value (LTV) ratio being 40-50%, the market would need to see a sharp plunge in housing prices for home equity to turn negative. We see this as unlikely; maintaining price stability is the government’s policy objective given that 40% of loans use property assets as collateral.

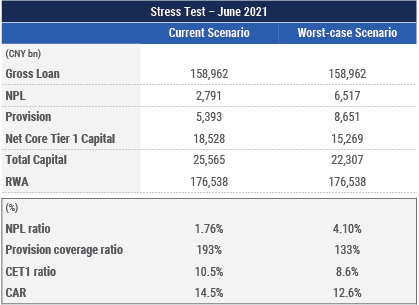

In a worst-case stress scenario, the NPL ratio would climb to 25% for developers (from <2% today) and 5% for mortgages (from <0.5%) currently), and assuming a loss-given-default (LGD) ratio of 50%, we estimate the CET1 ratio to drop from the current 10.5% to 8.6% (versus the regulatory minimum of 7.5%). To be clear, these default rate assumptions are not our base case expectation, but a hypothetical stress test.

We would expect policy easing if there are signs of such a distress scenario materializing, considering the systemic importance of the sector in terms of direct and indirect GDP contribution.

Note: Stress Assumptions: Developer NPL ratio 25% vs. now <2%; Mortgage NPL ratio 5% vs. now <0.5%; Construction NPL ratio 5% vs. now <2%; LGD ratio 50%

Source: CBIRC, PineBridge estimates as of 24 September 2021. For illustrative purposes only. We are not soliciting or recommending any action based on this material. Any opinions, projections, estimates, forecasts, and forward-looking statements presented herein are valid only as of the date of this presentation and are subject to change.

More prudent allocation to the real estate sector in recent years

Banking sector exposure to real estate

Source: PBoC as of 30 June 2021. For illustrative purposes only. We are not soliciting or recommending any action based on this material. Any opinions, projections, estimates, forecasts, and forward-looking statements presented herein are valid only as of the date of this presentation and are subject to change.

Banking system capital ratios

Source: CBIRC, PineBridge estimates as of 30 June 2021. For illustrative purposes only. We are not soliciting or recommending any action based on this material. Any opinions, projections, estimates, forecasts, and forward-looking statements presented herein are valid only as of the date of this presentation and are subject to change.

Based on our analysis, the onshore banking system can absorb the shock even under the worst-case scenario as shown above, which also suggests that a systematic crisis is unlikely to happen.

Pressure building on China’s property sector

Domestically, a large-scale credit event would put pressure on the property sector, particularly for highly leveraged players and the lending banks.

In the above worst-case scenario, real estate would be negatively impacted by significant declines in volume and prices in the physical property market from two key sources. First, it could trigger a fire-sale of Evergrande’s inventory, leading to significant downward pressure on housing prices. This, in turn, would suppress the profitability of its peers and reduce homeowner wealth. Second, the failure of Evergrande to deliver pre-sold housing units could lead to significant losses for homebuyers and a confidence crisis among other developers.

As China’s largest property developer, Evergrande’s potential collapse also has a knock-on effect on numerous suppliers and its employees. This creates an ever more complicated resolution process with potential for unintended social issues and contagion risks.

In line with this, we believe the worst-case scenario is unlikely given the potential social and economic disruption that would arise. Instead, a restructuring scenario is more likely, with protection for homebuyers and suppliers the top priority. Already, Evergrande is prohibited in several cities from selling property at prices deemed too low, due to concerns over unfair market competition. This reflects the focus of the authorities on maintaining market stability amid the policy tightening cycle.

More broadly, investors can also reference recent incidents of financial distress involving large Chinese companies where the government has been involved in the resolution to prevent contagion.

Evergrande’s crisis should also not be a surprise. The credit tightening bias towards the Chinese property sector has been in place for some time; since 2018, developers have only been allowed to issue offshore bonds to refinance outstanding offshore debt. Recently, the “three red lines” policy was introduced, aiming to reduce overall leverage in the sector and at the company level. This policy has led to a fundamental divergence in the sector, with stronger names starting a deleveraging cycle while weaker ones faced liquidity pressure.

While many developers have subsequently accelerated asset disposals, property sales, and other measures to increase cash flow or pay down debts, the market dynamics have deteriorated more sharply than expected for the weakest names as the property market in China cools off. Besides Evergrande, a few property developers defaulted since the beginning of the year; however, at the same time, there are also property developers continuing to exhibit deleveraging trends.

What happens to China’s tightening policy?

We believe policy relaxation is unlikely in the near term. It is still too early to call for the reversal of sector policy direction, given we are at the start of the deceleration and property sales activity in the past year was still elevated. We also believe today’s policy makers are more determined in cooling down the sector than those in the previous cycles. They appear to view control over the housing market as being of long-term national strategic importance as part of efforts to address issues such as low birth rates, systemic risk, credit allocation, and wealth inequality.

That said, if the self-inflicted deceleration is faster than targeted and creates significant drag on the economy (given the contribution of the property sector to GDP), we think at the margin policies will be fine-tuned to contain the tail risks.

Where next for investors in China’s fixed income market?

Evergrande’s US dollar-denominated bonds amount to approximately US$19 billion, or 5.5% of the JACI High Yield Index. As a result, the company’s current predicament has dragged performance of the asset class and will skew default rates. However, credit spreads in Asia high yield bonds – even if we exclude Evergrande – are pricing in close to a 10% implied default probability. This indicates significant fear of systemic risks.

In our view, since we do not believe Evergrande will result in contagion, we see the market as being excessively bearish.

In particular, the recent cases of high-profile defaults in China underscore our long-held belief in the need for thorough, independent credit research in fixed income investing across all sectors and the overall market.

We continue to see opportunities in the Chinese bond market, both onshore and offshore. However, with the potential for more defaults, we cannot overemphasize the need to get credit analysis right, instead of relying on external credit ratings or hard-to-quantify implicit government support as the basis for an investment.

We also believe current rating methodologies of international and onshore credit rating agencies need to be revised to better reflect intrinsic credit risk domestically. It is positive to see recent central government initiatives to develop credit approaches in the onshore credit rating process, as they should help improve the quality of credit ratings.

In short, as China continues to undergo policy and market reforms and pushes forward market liberalization, including foreign access to onshore capital markets, international investors should consider partnering with asset managers that have a strong on-the-ground capability to help navigate this complex yet potentially alpha-rich market.

Footnote

1 Please see “China Huarong announces state bailout alongside $16bn loss,” Nikkei Asia, 19 August 2021: https://asia.nikkei.com/Business/Markets/China-debt-crunch/China-Huarong-announces-state-bailout-alongside-16bn-loss

Disclosure

Investing involves risk, including possible loss of principal. The information presented herein is for illustrative purposes only and should not be considered reflective of any particular security, strategy, or investment product. It represents a general assessment of the markets at a specific time and is not a guarantee of future performance results or market movement. This material does not constitute investment, financial, legal, tax, or other advice; investment research or a product of any research department; an offer to sell, or the solicitation of an offer to purchase any security or interest in a fund; or a recommendation for any investment product or strategy. PineBridge Investments is not soliciting or recommending any action based on information in this document. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of PineBridge Investments, and are only for general informational purposes as of the date indicated. Views may be based on third-party data that has not been independently verified. PineBridge Investments does not approve of or endorse any republication of this material. You are solely responsible for deciding whether any investment product or strategy is appropriate for you based upon your investment goals, financial situation and tolerance for risk.

Fixed Income

Discover PineBridge’s range of fixed income offerings

Recent Insights