2025 Midyear Asia Fixed Income Outlook: Another Year, Another Show of Resilience

Omar Slim, CFA

Co-Head of Asia Fixed Income

Andy Suen, CFA, FRM

Co-Head of Asia Fixed Income

President Trump’s “Liberation Day” tariffs, if they stick, would hit export-heavy Asian economies like Vietnam (even with the new tariff agreement) and Thailand hardest, while diversified markets such as India and Singapore would be less affected.

Asian credit markets remain resilient due to stable fundamentals, a supportive investor base, and limited US exposure.

Asia’s low inflation allows room for rate cuts, with the notable exception of Japan.

Asia credit could further benefit from investors rethinking their US exposure.

Asia’s economies are navigating a pivotal moment. US President Donald Trump’s April “Liberation Day” tariffs hit regional economies – particularly export-driven nations such as Vietnam and Thailand – harder than most had expected. Yet despite widespread market volatility in the second quarter of 2025, Asian credit issuers have demonstrated continued resilience, supported by stable fundamentals and strong technicals.

Much still hangs in the balance. Tariffs will be effective from 1 August, and the extent of their impact on the region depends on where the numbers finally land. The PineBridge Asia Fixed Income Team conducted a stress test based on the Liberation Day tariff rates. Ranking countries by exposure, Vietnam, Thailand, and China face the most significant risks, followed by South Korea, Malaysia, and Indonesia. In contrast, India, the Philippines, and Singapore (along with Australia) appeared least affected, thanks to their more-diversified trade profiles.

Major Asia Economies Can Weather the Upcoming Trade Tariff Disruption

Source: PineBridge Investments estimates for Asian countries and the IMF World Economic Outlook for others. Actual data as of 31 December 2024; forecast for 2025 as of 3 July 2025. For illustrative purposes only. Any opinions, projections, forecasts, or forward-looking statements presented are valid only as of the date indicated and are subject to change. Diversification does not necessarily ensure against market loss. Past performance, or any prediction, projection, or forecast, is not indicative of future performance.

In the calculation of GDP growth impact (ppt), we adopted an assumption on US import elasticity, -2 for China, and -1 for the rest of the countries. Assumed tariffs per US announcement as of 2 April 2025. *With exception of China as of 12 May 2025, Vietnam as of 2 July 2025.

Still, we believe most major economies are well positioned to deploy fiscal and monetary measures to cushion the impact. Furthermore, as our previous analysis shows, few Asian credit issuers have significant exposure to the US. Asian high yield (HY) issuers, being more domestically and regionally focused, are even more insulated than their investment grade (IG) counterparts.

The proof in the pudding lies in the returns Asia credit has generated in the first half of 2025. Asia credit markets posted a return of 3.82%, as measured by the JP Morgan Asia Credit Index (JACI). More specifically, Asia IG returned 3.79%, according to the JACI Investment Grade Index, while Asia HY delivered a return of 4.05%, based on the JACI Non-Investment Grade Index.1

Regional strength in monetary policy and fundamentals

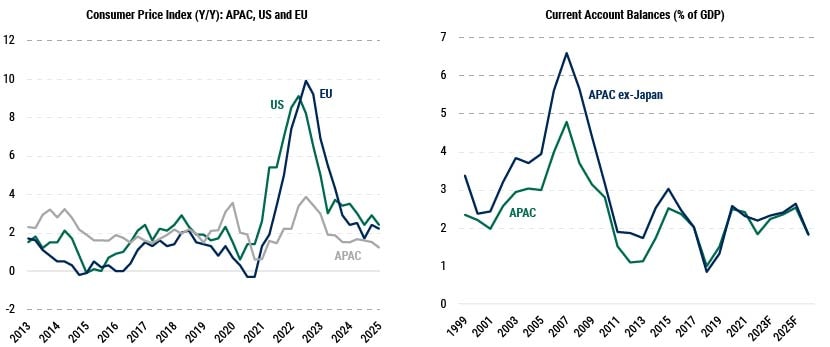

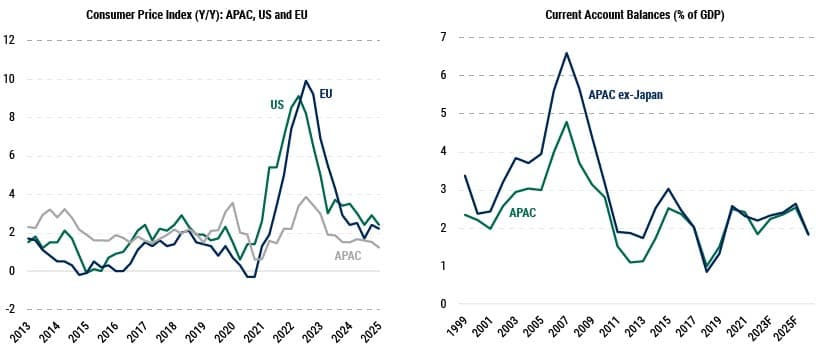

The resilience of the asset class extends to the region’s relatively stronger monetary and fiscal positions. Rather than fuel inflation, as they will likely do in the US, the tariffs should exert deflationary pressure in Asia. To begin with, inflation has been subdued across the region. The possible re-routing of goods to these markets, along with China’s ongoing deflationary pressures, will bring prices down, providing room for further rate cuts if growth slows.

In contrast to the rising sovereign risk in developed markets, most Asian countries are managing their public finances prudently. Budget deficits remain contained, with the exception of China, where fiscal stimulus is ramping up. However, even in China, the stimulatory measures remain tepid. Regional credit ratings are mostly stable, and current account balances are healthy.

Asian Fundamentals Look Healthy

Source: Bloomberg. (Left) As of 31 March 2025; (Right) As of 30 June 2025. For illustrative purposes only. We are not soliciting or recommending any action based on this material. Any opinions, projections, estimates, forecasts, and forward-looking statements presented herein are valid only as of the date of this presentation and are subject to change.

These dynamics, along with investors looking to diversify away from the US, could bolster Asia USD credit. Investors who used to allocate more tactically to Asia fixed income may now view the asset class as a strategic diversifier in their overall portfolios – and in our view, those who do not should consider doing so.

Asset Class Snapshots

Asia investment grade (USD): tried and tested

Despite macro headwinds, Asia IG has once more demonstrated its stability, underpinned by steady fundamentals. Credit metrics remain robust across the region, with balance sheets well-positioned to absorb moderate shocks.

Over the past two years, the supply of Asia IG credit has evolved, making the asset class more diversified and enhancing its appeal. Japanese and Australian corporates have stepped up issuance, reflecting both investor appetite and issuer confidence, while Chinese supply has declined.

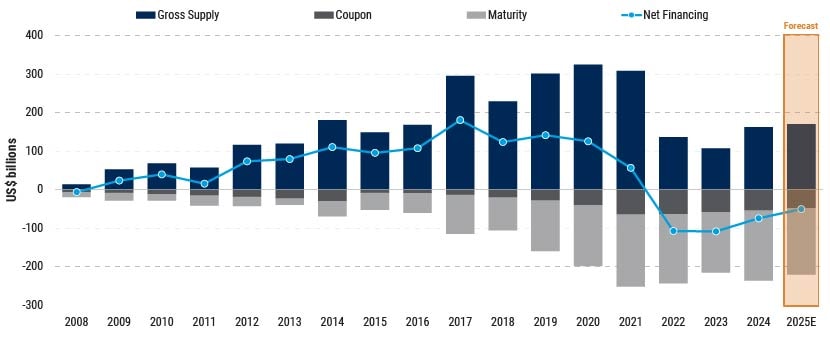

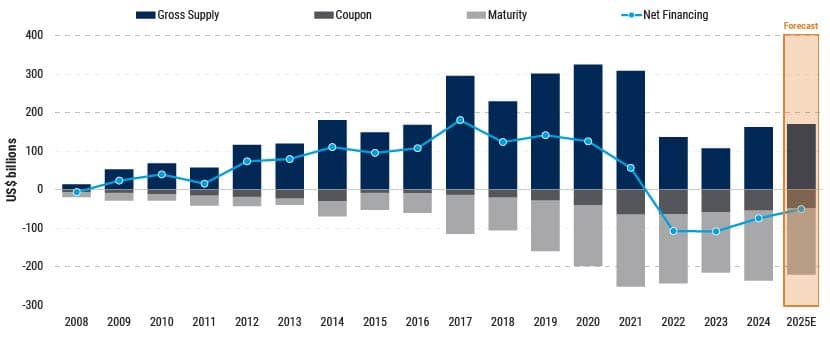

Meanwhile, technicals for Asia IG remain strong. Maturing bonds and coupon repayments continue to outpace supply, particularly in high-quality names, and investor positioning remains constructive.

Technicals Are Supportive, With Maturities Exceeding New Issuance

Data as of 3 July 2025. Source: JP Morgan, PineBridge Investments. Asia Credit Market represented by JP Morgan Asia Credit Index. For illustrative purposes only. Any opinions, projections, forecasts, or forward-looking statements presented are valid only as of the date indicated and are subject to change.

While we anticipate some marginal widening in select segments – particularly if global risk sentiment deteriorates – we expect this to be contained. The broader takeaway is clear: The resilience of Asia IG has been tested once again, and it has delivered.

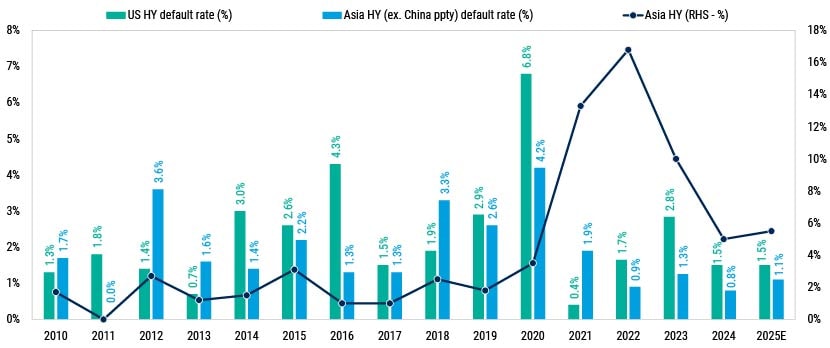

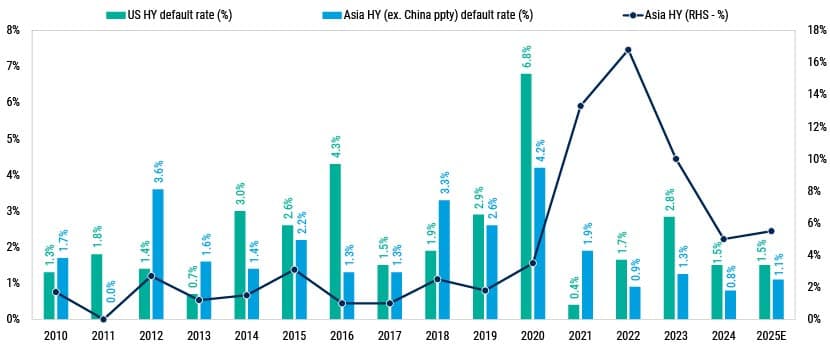

Asia high yield (USD): compelling carry

The outlook for Asia HY remains broadly constructive, albeit with some nuances. Default rates have declined over the past two years, and excluding the distressed China property sector, they have stayed consistently low. This trend has continued year-to-date, and we expect it to hold through the rest of the year as China’s property sector further contracts and other segments remain broadly stable.

Asia (ex China Property) Boasts a Lower Default Rate Than US HY

As of 30 June 2025. Source: JP Morgan, PineBridge Investments. For illustrative purposes only. Any opinions, projections, forecasts, or forward-looking statements presented herein represent the views of the manager, are valid only as of the date of this document, and are subject to change.

From a yield perspective, Asia HY continues to offer attractive carry with low duration, especially when compared with high yield bonds in developed markets. While some names – particularly in commodity-linked sectors – may face pressure from a broader economic slowdown, we believe the impact will be manageable. At the same time, sectors tied to domestic demand could benefit if governments bump up stimulus to offset export weakness.

Spreads could be volatile amid ongoing trade policy uncertainty. However, we view any weakness in high-quality names as a potential buying opportunity. Importantly, major sectors such as Indian corporates and high-quality Chinese issuers continue to enjoy solid access to local-currency markets. These companies also benefit from monetary easing, which helps mitigate refinancing risk.

All told, as the Asian USD credit market continues to grow and evolve, its resilience remains a defining feature – and one that is attracting more global investor interest.

For more insights into the trends moving markets in the second half of the year, see our 2025 Midyear Investment Outlook.

1 Source: J.P. Morgan as of 30 June 2025.

Disclosure

Investing involves risk, including possible loss of principal. The information presented herein is for illustrative purposes only and should not be considered reflective of any particular security, strategy, or investment product. It represents a general assessment of the markets at a specific time and is not a guarantee of future performance results or market movement. This material does not constitute investment, financial, legal, tax, or other advice; investment research or a product of any research department; an offer to sell, or the solicitation of an offer to purchase any security or interest in a fund; or a recommendation for any investment product or strategy. PineBridge Investments is not soliciting or recommending any action based on information in this document. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of PineBridge Investments, and are only for general informational purposes as of the date indicated. Views may be based on third-party data that has not been independently verified. PineBridge Investments does not approve of or endorse any republication of this material. You are solely responsible for deciding whether any investment product or strategy is appropriate for you based upon your investment goals, financial situation and tolerance for risk.