Solvency II Revisited: Unlocking CLO Investments for European Insurers

Vladimir Zdorovenin, PhD

Head of International Insurance Solutions

The European Commission has put forward a package of regulatory reforms aimed at revitalizing the European securitization market. For insurers, the reform will significantly reduce capital charges for senior tranches of non-STS (simple, transparent, and standardized) securitizations, such as AAA rated CLOs, improving their Solvency II regulatory capital efficiency.

Lower capital requirements remove a key barrier for investments in securitized credit, enabling European insurers to re-engage with an asset class long underrepresented in their portfolios.

Paired with wider spreads and historically lower default rates versus comparable corporate bonds, improved capital efficiency can make high-quality securitizations an attractive addition to insurers’ fixed income portfolios.

The Solvency II prudent person principle requires that insurers invest only in assets whose risks they can adequately identify, measure, monitor, manage, control, and report. To meet these requirements when investing in securitized credit, insurers can partner with specialist asset managers that combine an active approach to security selection and portfolio construction with in-depth insurance regulation, accounting, and reporting expertise.

In June-July 2025, the European Commission published a long-anticipated package of measures aimed at reviving the European securitization market.1 When enacted, these measures will reduce and harmonize the risk-based capital requirements for insurers’ and banks’ investments in securitizations, as well as simplify the disclosure requirements and broaden the risk retention requirements for securitization originators.

For EU insurers operating under the Solvency II standard formula, the reform brings a significant improvement in the regulatory capital efficiency of investments in senior tranches of securitizations. Senior tranches of non-STS (simple, transparent, and standardized) securitizations, such as collateralized loan obligations (CLOs), emerge as the biggest winner. For example, the spread risk capital requirement for a AAA rated CLO tranche with a three-year modified duration will fall from 37.5% (broadly in line with the equity risk charge for listed equities) to 8.1% (broadly in line with typical spread risk charges for BBB rated corporate debt).

Since the early days of Solvency II, prohibitive capital charges have effectively barred most European insurers from making meaningful allocations to securitized credit. European insurance industry aggregate allocations to collateralized securities – including asset-backed securities (ABS), mortgage-backed securities (MBS), and CLOs, among others – make up only about 1% of total investments.2 This is in comparison to 15% for insurers in the US3 and 17% in Bermuda.4 The regulatory shift creates an opportunity for European insurers to narrow the gap with their global peers and build better-diversified, higher-yielding portfolios by re-engaging with high-quality securitized credit across public and private markets.

Here, we summarize the proposed changes and quantify the reform’s impact on the capital efficiency of insurers’ investments in CLO tranches.

What are the new capital requirements for insurers’ investments in securitizations?

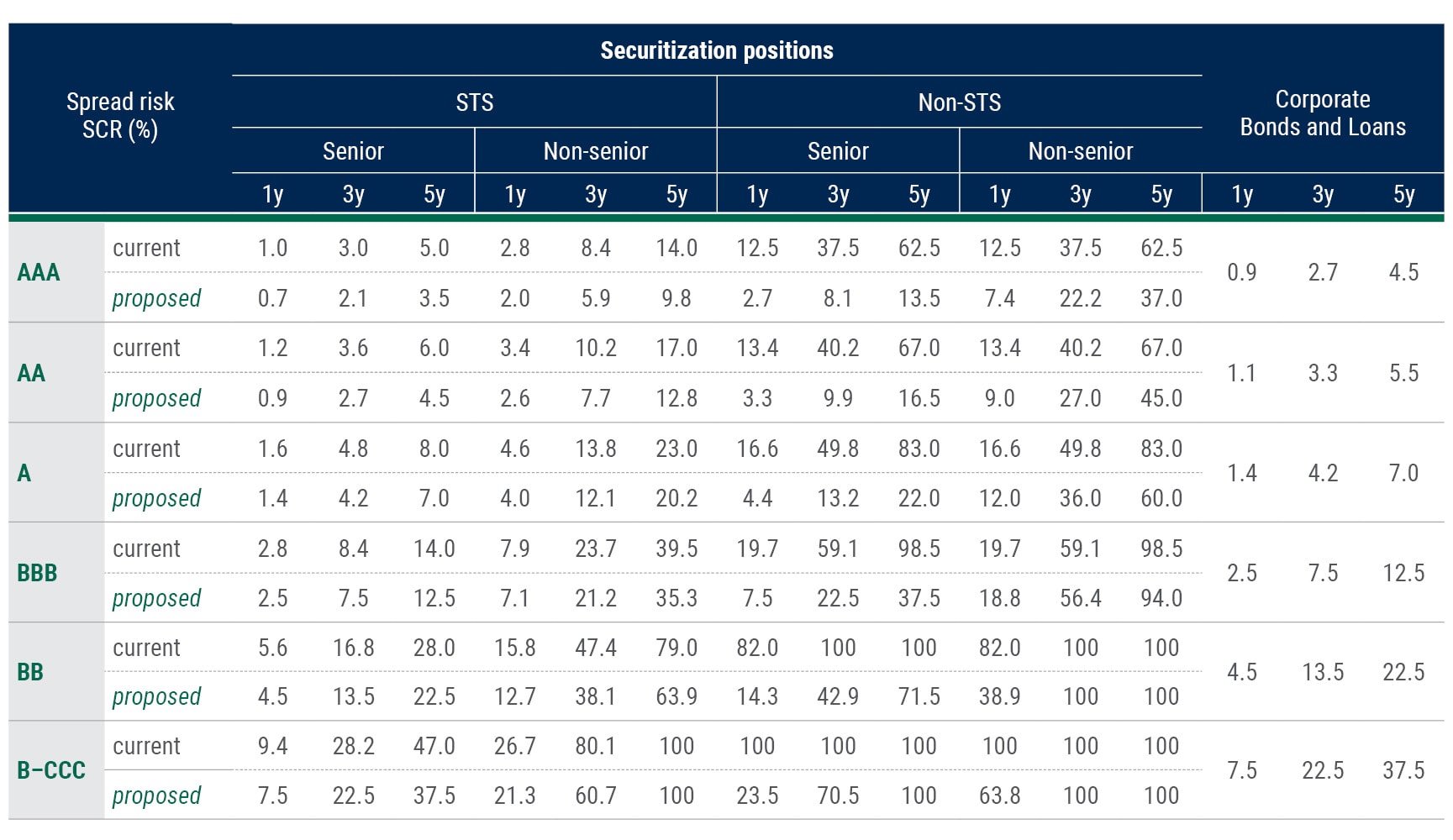

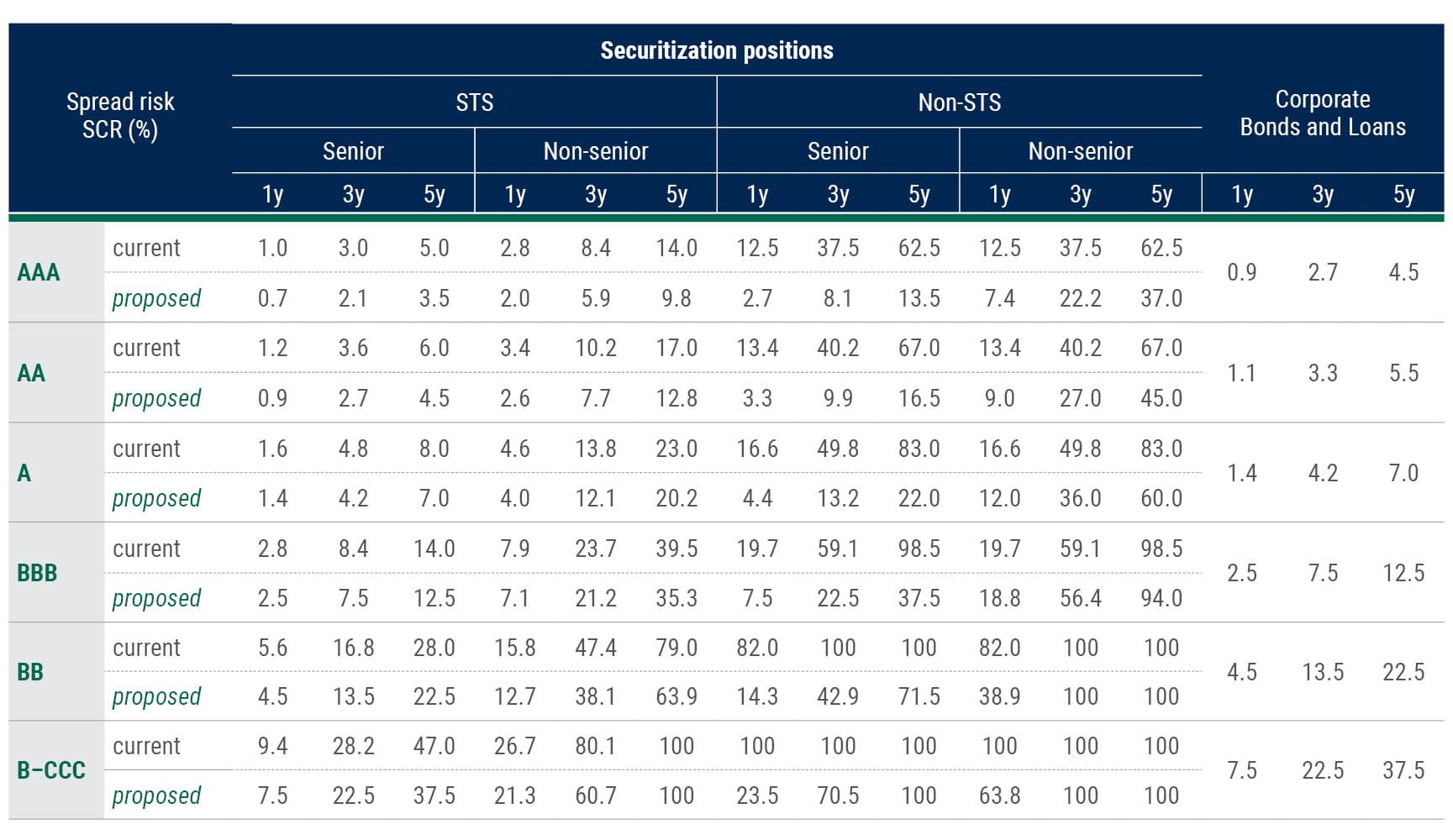

The Solvency II standard formula currently distinguishes between STS securitizations and non-STS securitizations.5 Spread risk capital charges vary significantly by tranche seniority (for STS securitizations), modified duration, and rating.

The senior-most tranches of STS securitizations benefit from relatively modest spread risk charges, typically ranging from 1.10 to 1.25 times those applied to comparable corporate debt exposures. In contrast, non-senior investment grade STS tranches incur significantly higher charges – up to three times those applied to comparable corporate debt. Non-STS securitizations, regardless of tranche seniority, incur steep capital charges of up to 100%.

The narrow definition of an STS securitization means that only a small proportion of securitizations qualify as STS-compliant (see the Key Terms Glossary below). The remainder bear punitive capital charges under the standard formula, which are sharply at odds with the historical performance of securitized credit in the post-global financial crisis landscape. Combined with risk retention requirements for securitization originators, this has effectively prevented most insurers from making meaningful allocations to the asset class.

The reform aims to remove some of these obstacles by recalibrating spread risk capital requirements and reducing capital charges across all securitization types.6 The most significant relief is expected for senior tranches of non-STS securitizations.

For STS securitizations, spread risk charges will fall by a factor between 0.7 and 0.9, bringing their treatment closer to that of high-quality corporate debt and covered bonds. For example, an AAA rated ABS tranche (classified as a senior STS securitization) will carry a capital charge comparable to that of a covered bond and below that of a same-rated corporate bond or loan.

Crucially, the revised framework introduces differentiation within non-STS securitizations based on tranche seniority. An AAA rated CLO tranche (classified as a senior non-STS securitization) will be treated broadly on par with a BBB rated corporate debt exposure – a significant enhancement to the current regime.

Solvency II Standard Formula Spread Risk Capital Requirements for Securitization Positions: Current and Proposed Regime

Source: PineBridge Investments interpretation of European Commission (19 July 2025) Draft Delegated Regulation amending Delegated Regulation (EU) 2015/35 on Solvency II (Ref. Ares(2025)5843909 - 17/07/2025), European Commission (16 November 2024) Delegated Regulation (EU) 2015/35 of 10 October 2014 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Document 02015R0035-20241114).

How will the reform impact the relative value of CLO tranche investments for insurers?

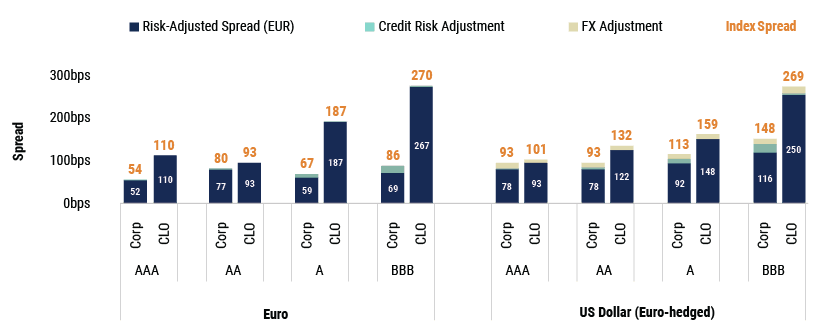

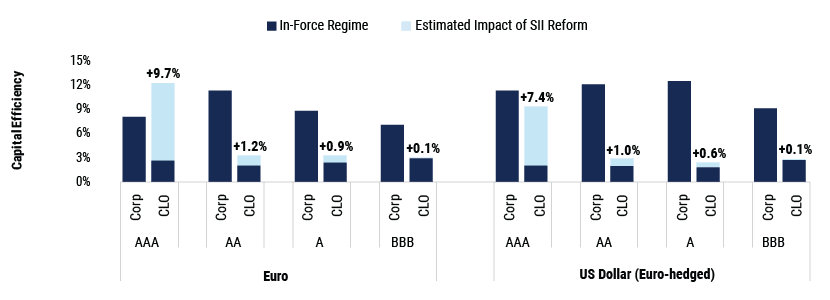

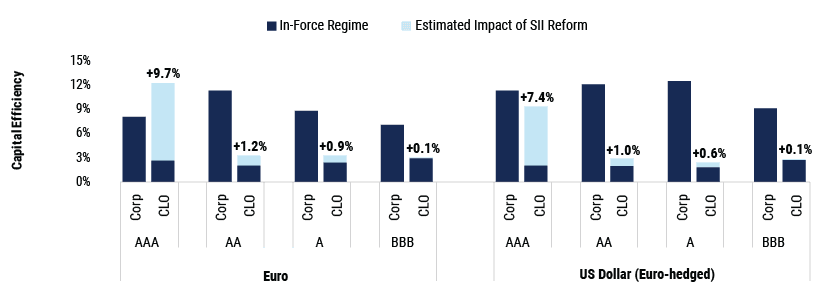

The new regulations will lower capital requirements, thereby improving the return on regulatory capital for insurers’ investments in securitizations, particularly for AAA rated CLO tranches. Our analysis of current market spreads and expected capital requirements suggests that lower capital requirements, coupled with spread pick-up over comparable corporate bonds, will make AAA CLOs an attractive addition to insurers’ fixed income portfolios.

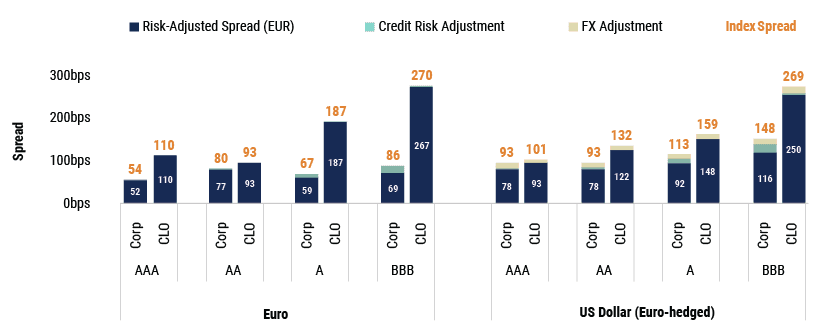

Relative Value: Spreads on CLO Tranches vs. Corporate Bonds

Updated 9 September 2025

Capital Efficiency: Expected Impact of Regulation Reform

Source: PineBridge Investments analysis based on ICE Index Platform, JPMorgan, Bloomberg (as of 31 August 2025), Moody’s (as of 4 August 2025), and PineBridge Investments interpretation of European Commission (19 July 2025) Draft Delegated Regulation amending Delegated Regulation (EU) 2015/35 on Solvency II (Ref. Ares(2025)5843909 - 17/07/2025), European Commission (16 November 2024) Delegated Regulation (EU) 2015/35 of 10 October 2014 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Document 02015R0035-20241114).

Index Spread is bond index Swap OAS or CLO index discount margin. Risk-Adjusted Spread (EUR) is corporate bonds index Swap OAS / or CLO index discount margin (to worst – simple average), adjusted for annualized expected cost of hedging USD investments into EUR (based on fair-value cross-currency swap rates estimated by Bloomberg) and for credit risk (based on historical credit loss on global corporate debt and CLOs estimated from Moody’s long-term default and recovery statistics).

Solvency II Capital Efficiency is the ratio of index spread (adjusted for the expected impact of credit risk and cross-currency hedging) to Solvency II standard formula capital requirement for spread risk (based on index rating and modified duration).

Historically, CLO tranches have offered investors an attractive risk-return profile, rewarding them for taking on complexity rather than default risk. On average, from 1993 to 2024, the five-year cumulative loss rate for CLO tranches rated investment grade at origination was 4 bps (compared to 78 bps for speculative grade tranches),7 whereas the comparable long-term average for investment grade corporate bonds was over 50 bps.8 The floating-rate coupon also means that CLO tranches can diversify insurers’ portfolios, which largely comprise longer-dated fixed rate bonds. This can be particularly beneficial in periods of elevated interest rate volatility, such as during the post-Covid tightening of 2022-2023.9

Although regulatory capital efficiency is a significant consideration for insurance investors, it is by no means the only driver of an insurer’s investment strategy. Partnering with a specialized asset manager that combines an active approach to security selection and portfolio management with a comprehensive understanding of the insurance balance sheet and the ever-changing regulatory landscape can help insurers unlock the benefits of securitization investments -- as well as to meet the prudent person principle requirement that insurers invest only in assets whose risks they can adequately identify, measure, monitor, manage, control, and report.

We believe the EU reforms will help unlock a compelling market for European insurers looking to build better-diversified, higher-yielding fixed income portfolios.

Key Terms Glossary: Securitization Investments Under Solvency II

Risk retention requirement

The originator, sponsor, or original lender must retain at least 5% of the net economic interest in the securitization on an ongoing basis using one of the following retention methods:

Vertical slice: Retain 5% of the nominal value of each tranche sold to investors

Originator’s interest: Retain 5% of the nominal value of each securitized exposure (common in revolving structures)

Random selection: Retain 5% of randomly selected exposures, provided they are not sold to third parties

First loss tranche: Retain 5% of the first-loss piece

Combination: A mix of the above, as long as the total equals 5%

The retained interest cannot be hedged or sold.

EU insurers are prohibited from investing in securitizations that do not meet the risk retention requirements.

The Solvency II reform proposes waiving risk retention for securitizations where the first-loss tranche represents at least 15% of the nominal value of the securitized exposures and is held (or guaranteed) by a narrowly defined list of public entities.10

Securitization

In the Solvency II context, securitization is a transaction or scheme characterized by:

Tranching: The credit risk is split into different levels (tranches) with varying seniority

Subordination: Losses are absorbed in order of tranche seniority, with junior tranches absorbing losses first

Performance-based payments: Investor returns depend on the cash flows from the underlying asset (e.g., a commercial real estate loan) or pool of assets (e.g., consumer loans, trade receivables)

Senior securitization position

A senior tranche is the highest-ranking tranche in the securitization structure. It is not subordinated to any other tranche in terms of credit risk and is protected by credit enhancement from junior tranches.

Simple, transparent, and standardized (STS) securitization

Simple:

The securitization must involve true sale of assets

The underlying exposures must be homogeneous and standardized (e.g., residential mortgages, auto loans); no re-securitizations

Transparent:

Investors must receive sufficient information on the underlying assets, cash flows, and structure

Investors must receive regular reporting based on standardized templates

Standardized:

The structure must follow standard risk retention, servicing, and documentation practices

There must be clear rules on allocation of cash flows and operation of triggers

Source: PineBridge Investments interpretation of Regulation (EU) 2017/2402 of the European Parliament and of the Council of 12 December 2017 laying down a general framework for securitization and creating a specific framework for simple, transparent, and standardized securitization, and amending Directives 2009/65/EC, 2009/138/EC and 2011/61/EU and Regulations (EC) No 1060/2009 and (EU) No 648/2012 (Document 32017R2402) and of Proposal for a regulation of the European Parliament and of the Council amending Regulation (EU) 2017/2402 of the European Parliament and of the Council of 12 December 2017 laying down a general framework for securitization and creating a specific framework for simple, transparent and standardized securitization (Document 52025PC0826).

1 Proposal for a regulation of the European Parliament and of the Council amending Regulation (EU) 2017/2402 of the European Parliament and of the Council of 12 December 2017 laying down a general framework for securitisation and creating a specific framework for simple, transparent and standardised securitisation (Document 52025PC0826).

2 PineBridge Investments analysis of EIOPA Insurance statistics – Group Quarterly Balance Sheet (retrieved 4 August 2025). “Total investments” comprise Investments (other than assets held for index-linked and unit-linked contracts), Loans and mortgages, and Cash and cash equivalents. Data as of 2024 Q3.

3 PineBridge Investments interpretation of US NAIC Capital Markets Bureau Special Report (2 May 2025) U.S. Insurance Industry’s Cash and Invested Assets Rise Over 5% to Close in on $9 Trillion as of Year-End 2024

4 PineBridge Investments interpretation of Bermuda Monetary Authority (5 September 2024) Private Credit – Deep dive on Direct Loans, CLOs, and Private Placements. Sum of weighted average allocations to RMBS, CMBS, CLO, and ABS.

5 Commission (16 November 2024) Delegated Regulation (EU) 2015/35 of 10 October 2014 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Document 02015R0035-20241114).

6 Draft Commission Delegated Regulation amending Delegated Regulation (EU) 2015/35 as regards technical provisions, long-term guarantee measures, own funds, equity risk, spread risk on securitisation positions, other standard formula capital requirements, reporting and disclosure, proportionality and group solvency (Ref. Ares(2025)5843909).

7 PineBridge Investments interpretation of Exhibit 39 in Moody’s Ratings (23 June 2025) Impairment and loss rates of structured finance securities: 1993-2024.

8 PineBridge Investments estimate based on 86 bps cumulative five-year default rate for investment grade global corporates (average over the period of 1970-2024) reported in Moody’s Ratings (4 August 2025) US municipal bond default and recovery rates: 1970-2024 and 37.9% average issuer-weighted recovery rate for Sr. Unsecured Bonds (based on trading prices, average over the period of 1983-2024) reported in Moody’s Ratings (27 March 2025) Default Trends – Global: Annual default study: Corporate default rate to fall below its long-term average in 2025.

9 For more on why CLOs could be a good addition to insurers’ investment portfolios, see PineBridge Investments (22 May 2023), “The Case for Collateralized Loan Obligations for Global Insurers.”

10 PineBridge Investments interpretation of Proposal for a regulation of the European Parliament and of the Council amending Regulation (EU) 2017/2402 of the European Parliament and of the Council of 12 December 2017 laying down a general framework for securitisation and creating a specific framework for simple, transparent and standardized securitization (Document 52025PC0826).

Disclosure

Investing involves risk, including possible loss of principal. The information presented herein is for illustrative purposes only and should not be considered reflective of any particular security, strategy, or investment product. It represents a general assessment of the markets at a specific time and is not a guarantee of future performance results or market movement. This material does not constitute investment, financial, legal, tax, or other advice; investment research or a product of any research department; an offer to sell, or the solicitation of an offer to purchase any security or interest in a fund; or a recommendation for any investment product or strategy. PineBridge Investments is not soliciting or recommending any action based on information in this document. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of PineBridge Investments, and are only for general informational purposes as of the date indicated. Views may be based on third-party data that has not been independently verified. PineBridge Investments does not approve of or endorse any republication of this material. You are solely responsible for deciding whether any investment product or strategy is appropriate for you based upon your investment goals, financial situation and tolerance for risk.