The Case for Global Leveraged Loans in a Deglobalized World

Kevin Wolfson

Portfolio Manager, US Leveraged Loans and CLO Management

Pavendeep Devgun

Senior Analyst and Portfolio Manager, Leveraged Finance

A global leveraged loan strategy may offer an attractive way to diversify sources of return, enhance portfolio resilience, manage risk, and access a deeper, more flexible credit universe to weather market shocks – key benefits against a fragmenting global economy marked by increased trade barriers, reshoring momentum, and protectionist agendas.

Both the US and European loan markets have experienced significant growth over the past decade, supported by strong expansion in the collateralized loan obligation (CLO) market and healthy supply from the private equity industry, which continues to view the market as an attractive, flexible source of capital.

Returns and default rates intermittently diverge between the US and Europe, making them complementary markets for global allocators with the expertise to capitalize on dislocation opportunities.

In an increasingly unpredictable macro environment, institutional investors are reassessing their geographic allocations across credit markets. We believe a global leveraged loan strategy offers a compelling way to diversify sources of return, enhance portfolio resilience, manage risk, and access a deeper, more flexible credit universe to weather market shocks – which is especially important against a fragmenting global backdrop.

Deglobalization is in motion

Sentiment at the beginning of 2025 was optimistic, underpinned by hopes of easing inflation, interest rate cuts, deregulation, and continued US exceptionalism. Yet the Trump administration’s policies quickly disrupted this narrative, initiating a burgeoning trade war and jeopardizing historical security alliances. These policies have also raised concerns about fading US exceptionalism. Uncertainties may weigh on consumer and investment spending until greater clarity around the end game emerges. US inflation is likely to head higher, at least in the short term, clouding the rate-cutting path for the Fed.

For the rest of the world, meanwhile, the tariffs are deflationary, as US demand for foreign exports falls and China seeks to reallocate trade to other markets, likely resulting in monetary policy divergence. Countries have reacted to US policies by threatening to impose retaliatory tariffs of their own and evaluating shifts to their supply chains. Europe – led by Germany – is increasing defense and infrastructure spending to protect its security interests as the US retreats.

While uncertainty persists about the outcome of trade discussions, what’s clear is that we are heading into a more deglobalized economy underpinned by increased trade barriers, reshoring momentum, and protectionist agendas.

The appeal of going global in loans

A more fragmented global economy – characterized by heightened policy and geopolitical uncertainty as well as divergent inflation, growth, and trade outlooks – underscores the importance of having a global view with respect to asset allocation.

The appeal of loans as an asset class to express a global orientation is centered around their healthy carry prospects and relative resilience to market volatility (anchored by demand from a stable CLO buyer base), along with a strong risk-return profile, seniority within the capital structure, and a moderately benign default outlook.

Going global with a loan allocation has many potential benefits for investors.

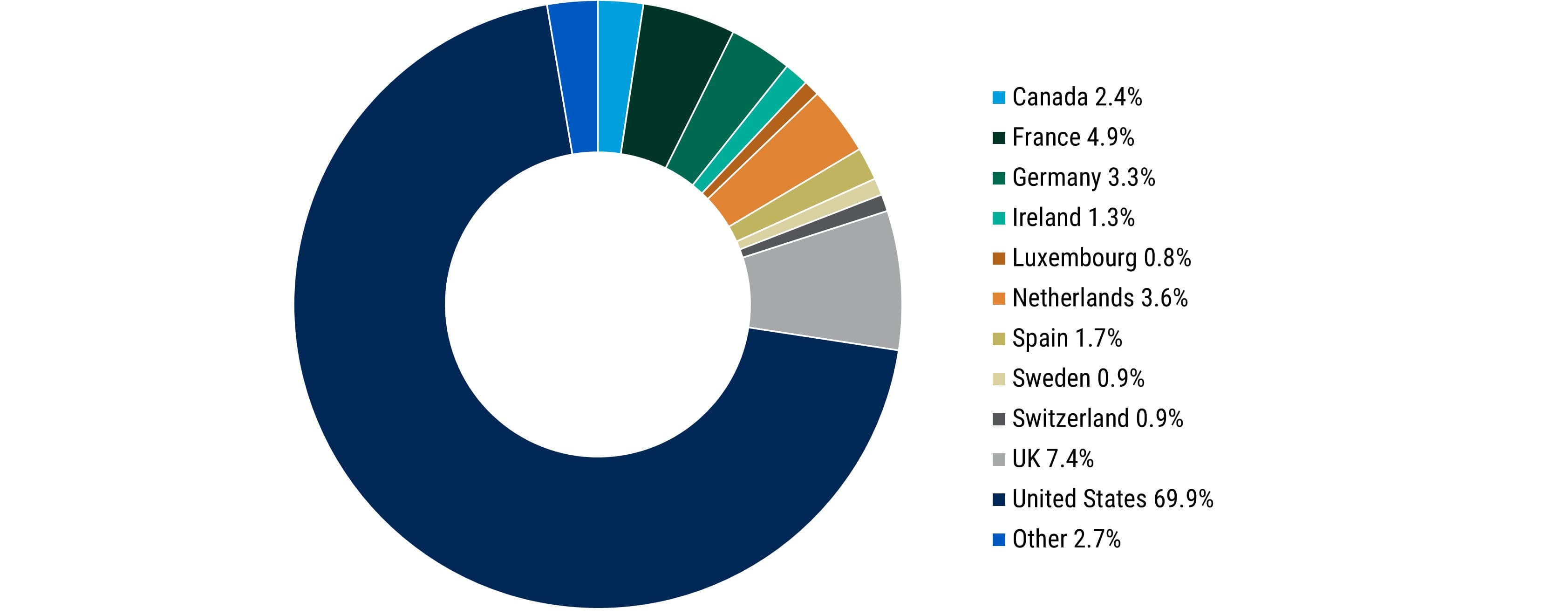

The Global Leveraged Loan Market: A Breakdown by Country

Source: Pitchbook US and European Leveraged Loan Index Factsheets as of 31 May 2025. “Other” category includes Australia, Belgium, Bermuda, Cayman Islands, Denmark, Hong Kong, Italy, New Zealand, Norway, and Singapore.

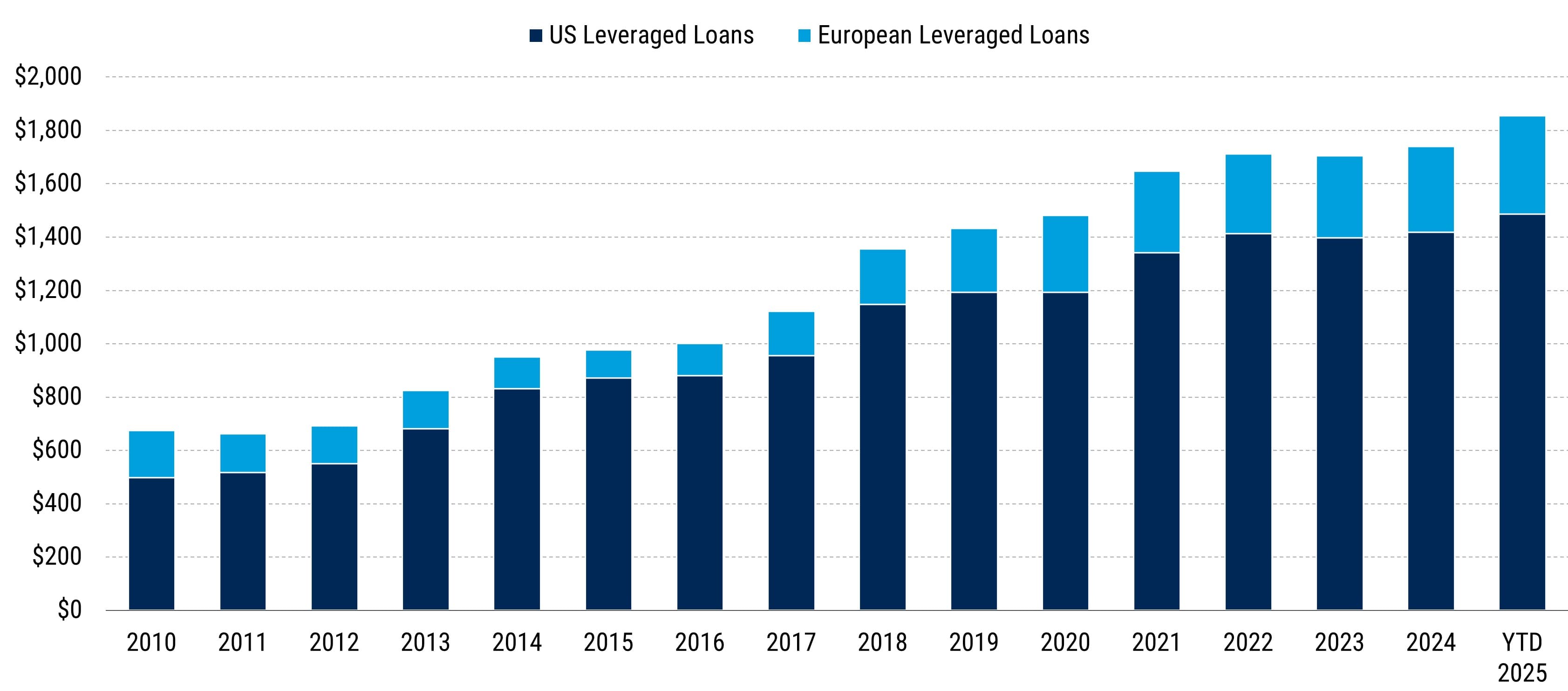

The loan market is large and growing, and widening the opportunity set allows for greater flexibility in building portfolios

Both the US and European loan markets have experienced significant growth over the past decade, supported by – among other factors – strong expansion in the CLO market and healthy supply from the private equity industry, which continues to view the market as an attractive, flexible source of capital.

Leveraged Loan Markets Have Witnessed Significant Growth

Global leveraged loan market par outstanding ($ bil.)

Source: Pitchbook US and European Leveraged Loan Index Factsheets as of 31 May 2025. US leveraged loans represented by the Morningstar LSTA Leveraged Loan Index, European leveraged loans represented by the Morningstar LSTA European Leveraged Loan Index.

Combining the US and European loan markets expands the overall investable universe by over four times in terms of both size and issuer count versus the European market alone. Versus a US-only loan focus, a global loan approach expands the investable universe by over 25% in terms of size and issuer count. Expanding the investable market allows for greater choice and flexibility in structuring portfolios and thereby improves diversification, durability, and risk-return potential.

Both the US and European markets exhibit diversity across industries. For example, while healthcare is one of the largest sectors in both markets – accounting for 8.2% of the US loan market and 13.3% of the European loan market – underlying credit quality for this sector varies significantly between the regions. The US healthcare sector faces a number of headwinds, including reimbursement challenges stemming from Medicare cuts, changes in revenue cycles under the No Surprises Act, high labor expenses fueled by soaring inflation, and steeper funding costs. Conversely, Europe’s healthcare market benefits from more stable reimbursement because it is made up of multiple distinct markets, many of which receive strong public funding. A global investor can benefit from the stable characteristics the sector has to offer while adjusting for the cross-border nuances in credit fundamentals.

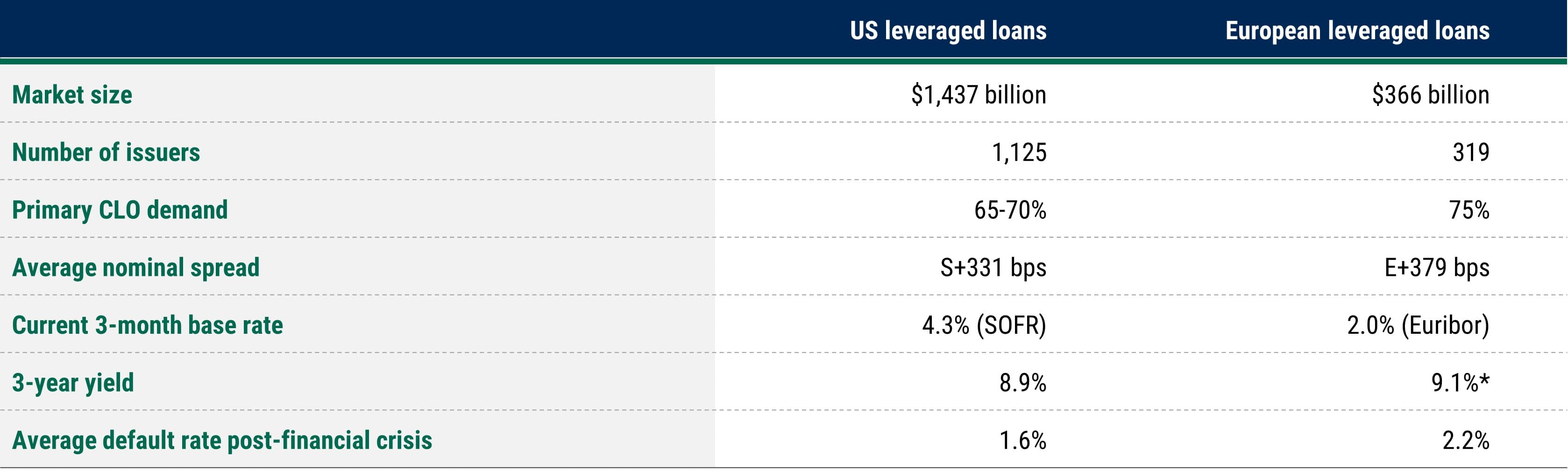

The US and European Leveraged Loan Markets Are Complementary

Source: Pitchbook as of 31 May 2025. US leveraged loans represented by the Morningstar LSTA Leveraged Loan Index; European leveraged loans represented by the Morningstar LSTA European Leveraged Index. *Reflects the three-year yield of the Morningstar European Leveraged Loan Index hedged to USD using three-month FX forward rates as of 31 May 2025.

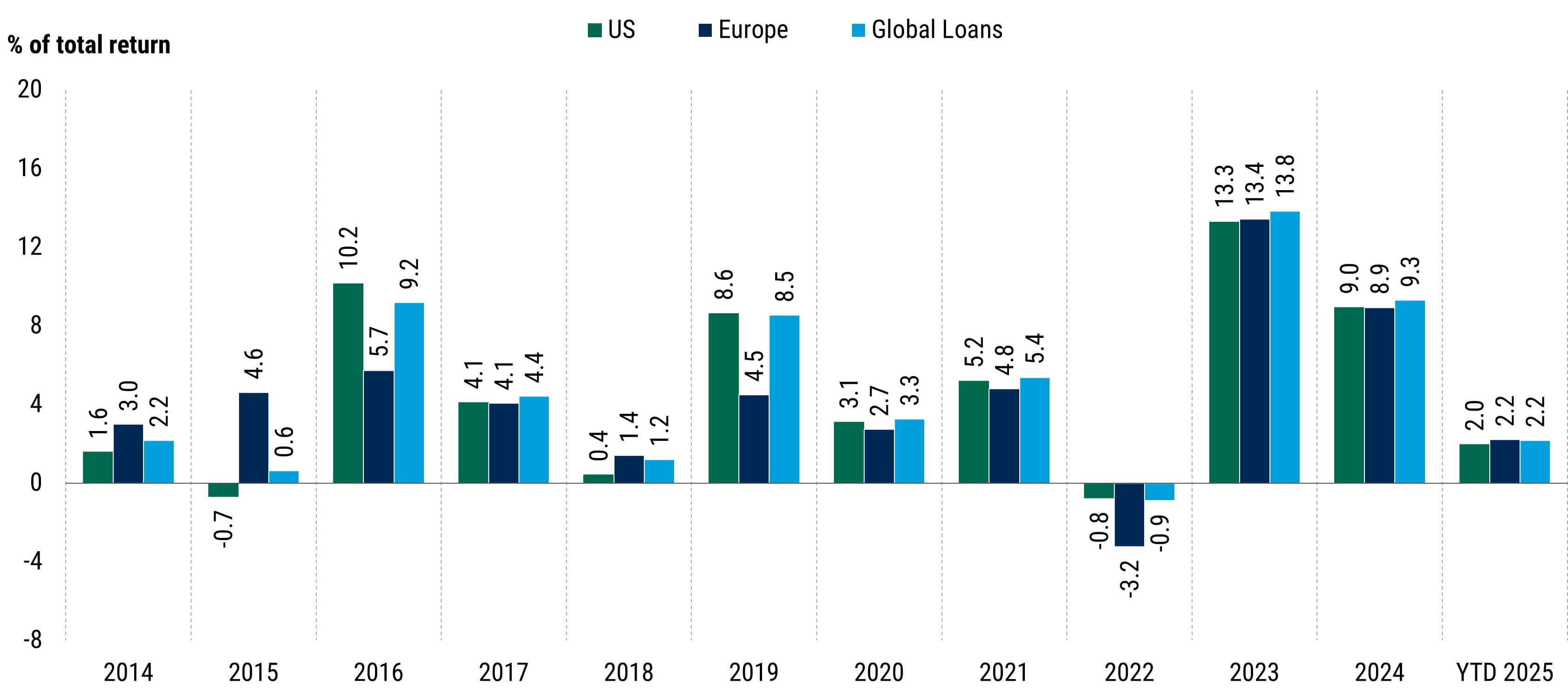

Geographic diversity provides alpha potential and enhances portfolio resilience to volatility in a given region

While credit selection should be viewed as the overriding source of alpha, the ability to allocate between the US and Europe and tilt portfolios on the margin depending on geographic views adds another potential contributor. To illustrate this point, the market can undergo shifting periods of out- and underperformance between the two regions. For example, in February 2022, when Russia invaded Ukraine, European loans underperformed through October 2022, returning -6.1% (-4.7% USD hedged) compared to -2.7% for US loans, on fears that higher commodity prices would drive the European economy toward a recession. Once it became evident that these fears were overdone, European loans outperformed from November 2022 through May 2023, returning 9.4% (11.1% USD hedged), compared to 5.8% for US loans.

US and Europe Loan Returns Intermittently Diverge, Favoring Active Allocation

Source: Morningstar LSTA as of 31 May 2025. For illustrative purposes only. US represented by the Morningstar LSTA Leveraged Loan Index, Europe represented by the Morningstar LSTA European Leveraged Loan Index ex-currency. Global Loans represented by an 80/20 mix of the US and European Indices hedged to USD.

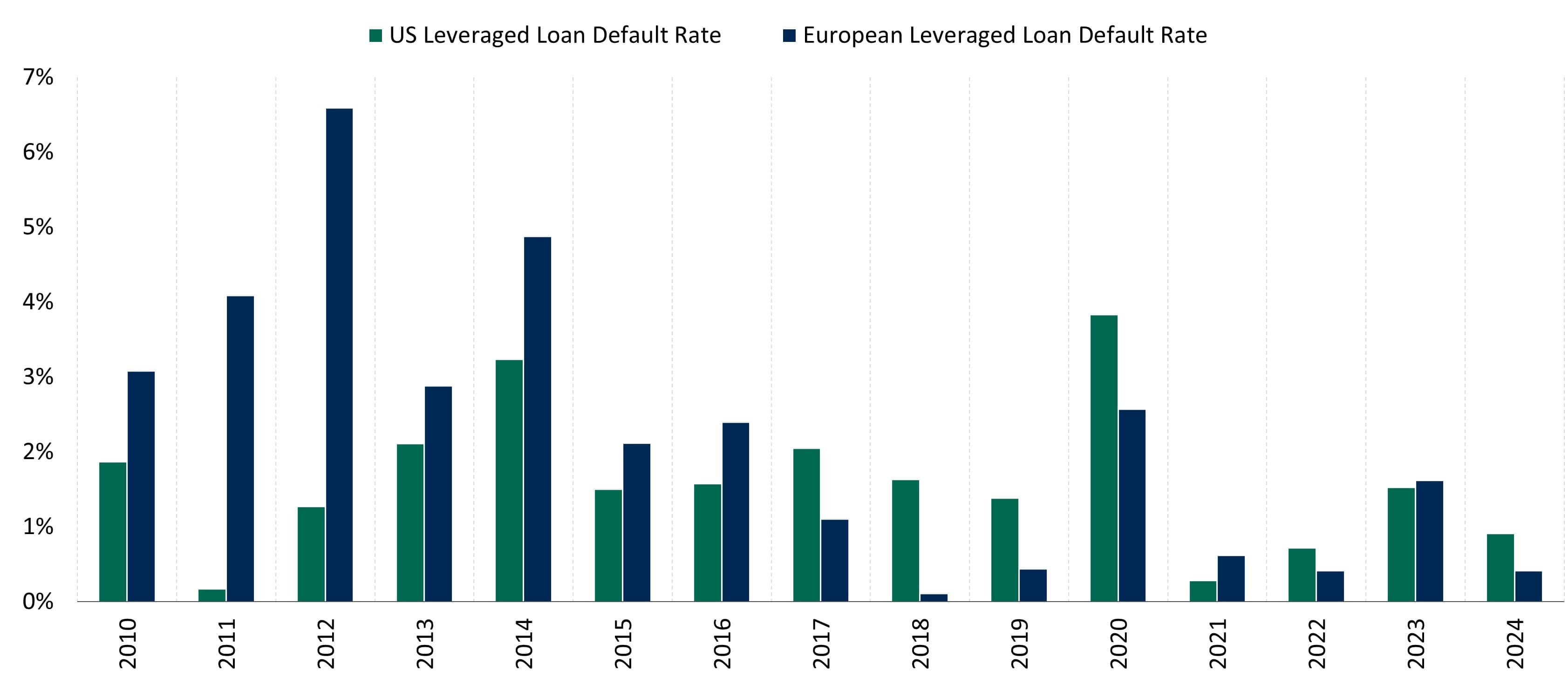

We have similarly seen divergence between default rates in these markets during select periods. For example, the eurozone debt crisis led to notably higher default rates in Europe in 2010-2014. In contrast, defaults in the US outpaced those in Europe from 2017-2019, when US borrowers faced rising interest rates and reduced fixed charge coverage ratios while their European counterparts saw an extended period of negative base rates and cleaner balance sheets. A global allocator with expertise in both markets can capitalize on such dislocation opportunities.

Loan Defaults in the US and Europe Have Often Varied

Europe and US leveraged loan default rates (post-financial crisis)

Source: Pitchbook as of 31 May 2025; represents year-end LTM default rate by amount outstanding. US leveraged loans represented by the Morningstar LSTA Leveraged Loan Index; European leveraged loans represented by the Morningstar LSTA European Leveraged Loan Index.

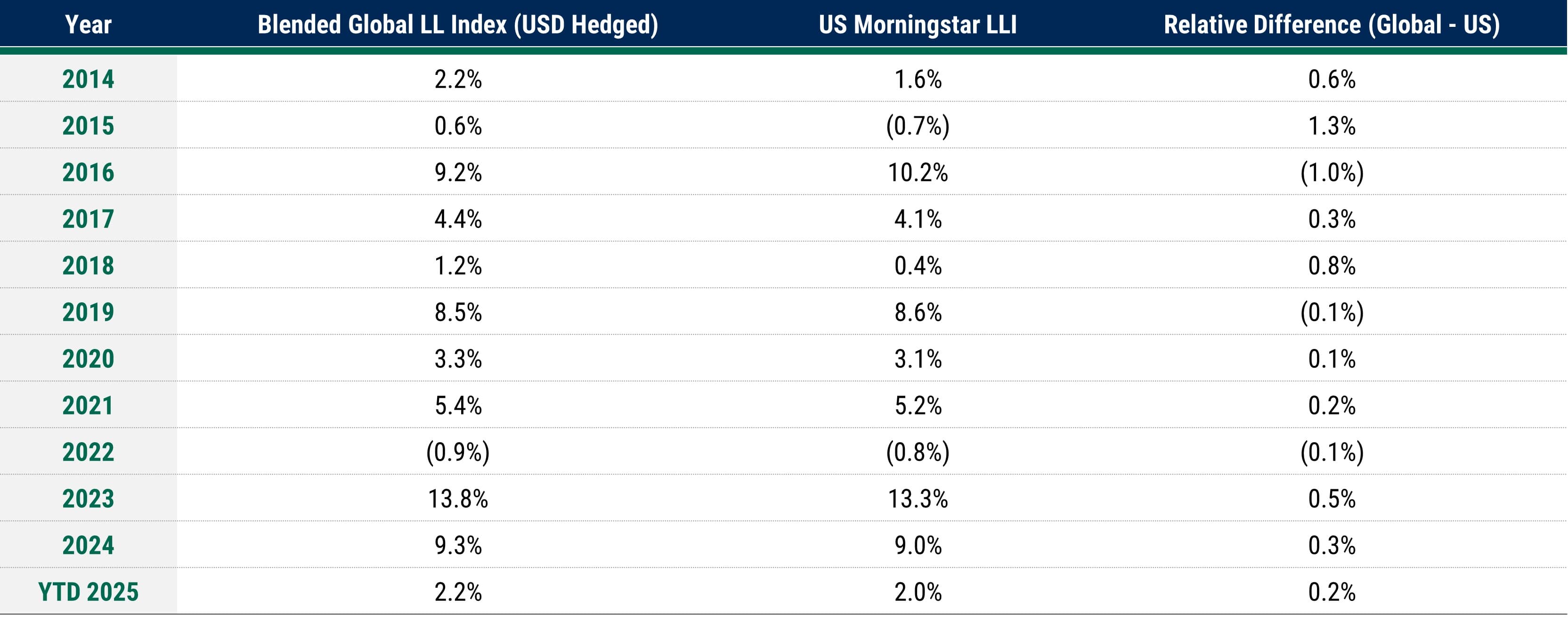

A global loan allocation can lead to a better risk-return profile

Over time, a globally diversified approach to loans has been shown to smooth out the variability in total returns compared to a US-only approach. Moreover, although current base rate differentials between the two markets offer a carry advantage to US loans in local currency terms given SOFR’s higher rate relative to Euribor, this can be largely compensated for by currency hedging for USD-denominated asset allocators. Additionally, European loans currently offer a spread advantage relative to USD-denominated loans. This difference in spread, coupled with the benefits of hedging the base rate, adds incremental relative value to a globally diversified portfolio.

Global Diversification Smooths Out Return Variability vs. a US-Only Approach

Annual Returns: Blended Global Index vs. US Index

Source: Pitchbook as of 31 May 2025. US leveraged loans represented by the Morningstar LSTA Leveraged Loan Index; European leveraged loans represented by the Morningstar LSTA European Leveraged Loan Index; Blended Global LL Index represented by an 80/20 mix of the US and European Indices.

Key risks to consider

While global loan allocations offer a number of potential benefits, leveraged loans do come with risks that investors should take into consideration.

Default risk. Though investing in most forms of credit carries some level of default risk, leveraged borrowers with lower credit ratings carry a higher risk of default than their investment grade counterparts. This risk can be managed by utilizing a robust underwriting process and placing a rigorous, continuous focus on credit selection.

Market liquidity risk. While the leveraged loan market benefits from secondary trading, not all loans are equally liquid. This risk can be managed by targeting larger loans, which are often the most liquid.

Currency risk. Investing in global loans can carry foreign exchange risk, which may affect the value of returns. This risk can be managed using currency hedging strategies.

Diversification reigns in a deglobalizing world

Developments this year indicate that we are entering a new period of deglobalization in which policy uncertainties and fracturing trade relationships are likely to keep disrupting the status quo. For these reasons, we believe that now more than ever, global diversification is a key component in investors’ risk management toolkit.

Loans remain an attractive asset class, with total return opportunities underpinned by strong carry appeal, stable technicals, and a relatively benign default outlook. We believe a global loan approach is compelling in today’s environment – the US and Europe together offer broader sources of alpha, combining regional asset allocation, issuer selection, and arbitrage of relative value between markets. Active managers with global investment capabilities in both the US and Europe and a track record of investing through economic cycles are positioned to react to dislocations and capitalize on this dynamic.

Disclosure

Investing involves risk, including possible loss of principal. The information presented herein is for illustrative purposes only and should not be considered reflective of any particular security, strategy, or investment product. It represents a general assessment of the markets at a specific time and is not a guarantee of future performance results or market movement. This material does not constitute investment, financial, legal, tax, or other advice; investment research or a product of any research department; an offer to sell, or the solicitation of an offer to purchase any security or interest in a fund; or a recommendation for any investment product or strategy. PineBridge Investments is not soliciting or recommending any action based on information in this document. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of PineBridge Investments, and are only for general informational purposes as of the date indicated. Views may be based on third-party data that has not been independently verified. PineBridge Investments does not approve of or endorse any republication of this material. You are solely responsible for deciding whether any investment product or strategy is appropriate for you based upon your investment goals, financial situation and tolerance for risk.