2024 Insurance Investment Outlook: Shifting Rules, Rates, and Risks

Helen Zhou Remeza, PhD

Head of Insurance Investment Strategies

Vladimir Zdorovenin, PhD

Head of International Insurance Solutions

Our base case for 2024 is a decelerating but broadly resilient economy that is supportive of higher-yielding credit assets. We favor a “barbell” approach with more defensive, lower-risk positions at one end and select higher-yielding, higher-risk assets at the other – to the extent that these assets offer attractive return on insurers’ regulatory and rating agency capital.

Geopolitics could roil investment portfolios in 2024 as record numbers of voters head to the polls, the war in Ukraine wears on, and violence in the Middle East escalates. Active portfolio management and global diversification may help insurers weather the uncertainty.

Amid growing macroeconomic divergence between the US, Europe, and Asia, European and US insurers may benefit from compelling opportunities in emerging market corporate debt and in Asia ex-Japan fixed income.

Life insurers’ overall strong liquidity position and stable long-term liabilities put them in a strong position to capitalize on banks’ retreat from direct lending and a thaw in the M&A market. While rigorous credit underwriting, portfolio stress testing, liquidity planning, and scenario analysis remain paramount considering the ongoing macro challenges, we believe that lower middle market private credit offers insurers a compelling risk-adjusted return potential.

We expect insurers’ investments in 2024 to be driven by a combination of evolving regulations and a pivot to rising rates – and with geopolitical risks creating uncertainty, active portfolio management with a focus on global diversification may help insurers weather vicissitudes in the markets. While these factors apply globally, each region faces particular challenges and opportunities as we look further into 2024.

The US: Well-positioned amid market and regulatory developments

A ‘generation gap’ between existing and new portfolios

While US insurers’ existing investment portfolios may be earning substantially lower income and will likely continue to for the foreseeable future, new premiums written have been deployed into sharply higher-yielding assets. The decade-long low-rate environment has depressed investment returns as insurers relied increasingly on underwriting profits to sustain surplus growth, but today’s higher rate environment is a tailwind for insurers. They can now roll proceeds from maturing portfolios, as well as free cash flows from new premiums written, into higher-rate assets, generating greater investment income and enhancing surplus.

For long-tail lines, support to earnings from higher investment yields will take place gradually, but for short-tail lines such as personal property and casualty (P&C), the transition is often much faster.

Undaunted by unrealized investment losses

An advantage for insurers (versus banks) is that even if existing portfolios are exposed to material unrealized losses due to rising rates, their fixed income investments are generally held to maturity. As a result, unrealized losses have little impact on cash flows, statutory surplus, or adherence with regulatory capital requirements. Overall, insurers face limited pressure to sell bonds at a loss, benefiting from asset-liability management and the overall “stickiness” of seasoned policies for long-tail lines such as life, annuity, and select P&C lines (including workers’ comp, etc.). Finally, regarding interest rate positioning, insurers generally stay neutral relative to their liability profile without the need to take extreme interest rate bets.

In search of high-quality assets with attractive carry

In a higher-rate environment, insurers generally have less pressure to go down in credit quality to enhance investment yield. However, given continued market uncertainty, we expect asset classes that offer attractive carry attributable to factors such as illiquidity and structuring premium (rather than incremental credit risk) to remain compelling for insurers. These may include high-quality private debt and CLOs. Leveraged finance portfolios with a defensive and diverse risk profile could also be well positioned. Outside the US, we see opportunities in dollar-denominated emerging market corporate debt as the growth differential continues. Commercial real estate (CRE) lending in select property sectors with strong credit profiles can offer opportunities as real estate repricing manifests fully over time.

Strong capitalization and liquidity help navigate uncertain markets

Insurers without capital and liquidity constraints can better weather market volatility. Except for select business lines and markets, most carriers were able to increase premium rates to combat inflation, a positive for underwriting profits. Higher current asset yields have also boosted investment income. Both tend to strengthen capital and liquidity for insurers. Furthermore, we expect US insurers to continue tapping into FHLB borrowings for liquidity and yield enhancement.

Evolving regulations impact insurance investments

The NAIC’s new principles-based bond definitions, to be implemented on 1 January 2025, would call for more granular statutory reporting of investment classifications. This could help regulators pinpoint problematic exposures and insurers. Furthermore, affiliated investments must be reported separately in new categories on Schedule D. This distinction is part of a growing focus on private equity- and asset manager-owned insurers, and how their investment portfolios are evolving. Lastly, the NAIC’s proposal on Securities Valuation Office (SVO) Filing Exemption discretion, new bond definition language around private funds, and CLO designation/risk-based capital revisions are still being heavily debated, and we expect 2024 to be another pivotal year for regulatory developments.

Europe: A steady course across choppy waters

Despite ominous clouds on the horizon a year ago, the major EU and UK insurers made it through to 2024 with no unpleasant surprises for their investment returns or overall business performance. Despite geopolitical tensions and outbreaks of armed conflict, along with spectacular bank failures, persistent inflation, and mounting pressure in the real estate sector, life insurers continued originating illiquid assets1 and reported strong investment returns and improving capital ratios, supported by minimal default and downgrade losses in their bond portfolios.2

Diverging outlooks between specialty and (re)insurers and P&C

Specialty insurers and reinsurers have benefited from strong rate increases, sustained claims levels, and higher yields on new investments in their relatively short-duration fixed income portfolios. On the flipside, primary insurers retained a higher share of their catastrophe risk exposure and struggled with persistent cost inflation, sometimes to the detriment of their shareholders.3 According to analysts, the outlook for primary P&C insurance remains bleak.4

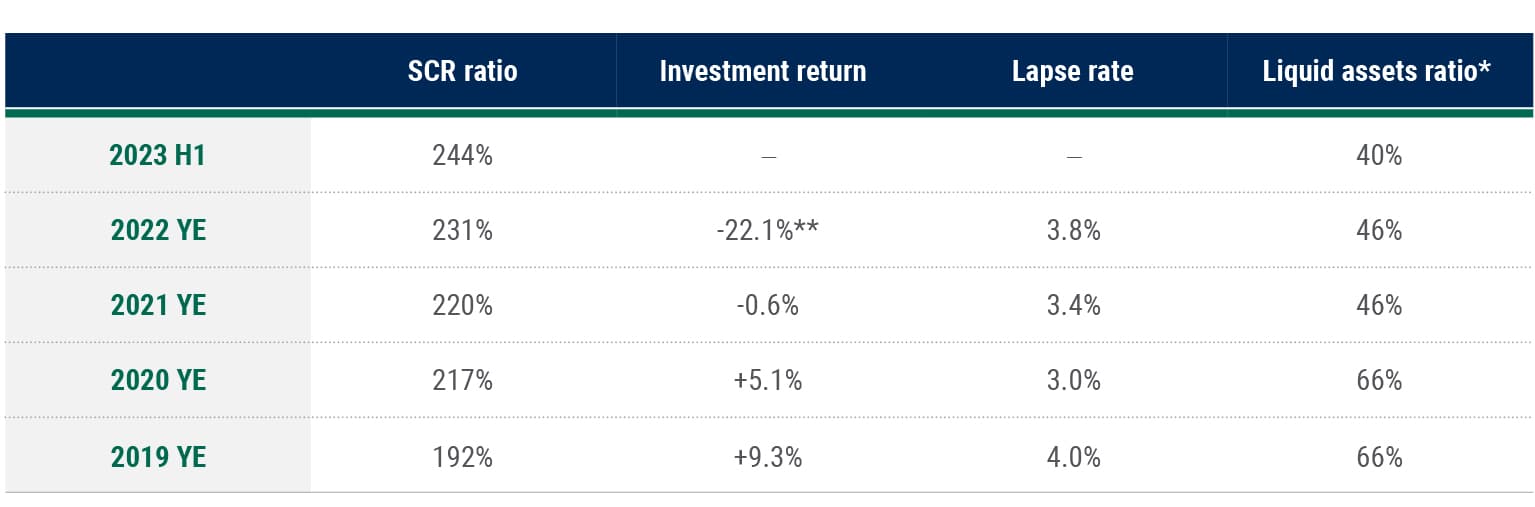

EEA Life Insurance Stats at a Glance: Year-end 2019 Through Midyear 2023

Source: EIOPA Risk Dashboards April 2020 (as of 31 January 2023), April 2021 (as of 31 January 2023), April 2022 (as of 31 January 2023), May 2023 (as of 15 May 2023), November 2023 (as of 24 November 2023). *All indicators are sample medians for life insurance solo undertakings except the liquid assets ratio, which is a sample median for a sample of life and non-life insurers. ** Investment return net of unrealized losses: +0.9%

Higher yields should boost returns on new investments in 2024

Driven by soaring interest rates in the post-Covid era, European Economic Area (EEA) insurers’ bond holdings shrunk from €3.99 trillion to €3.18 trillion between fourth-quarter 2020 and first-quarter 2023,5 with over €500 billion in unrealized losses estimated as of year-end 2023.6 However, insurers enjoyed some of the best fixed-income returns in recent history in 2023, and we expect them to continue benefiting from higher (though likely falling) yields on new bond investments. Barring forced sales in a liquidity stress scenario, life insurers will hold on to their long-dated high-quality bonds until maturity, allowing unrealized losses to be worn away by coupon income and pull to par.

Mass lapses could turn life insurers into forced sellers of assets – but in our view, this scenario remains highly unlikely for most insurers in 2024. In Italy, a market viewed as the most exposed to lapse risks, surrenders reached 7.8% of total life reserves in third-quarter 2023, compared with 4%-6% over 2015-2021, but are expected to revert closer to their normal levels in 2024.7 In France and Germany, lapse rates remained in line with long-term averages in 2023 despite the growing competition posed by higher rates on bank deposits, and analyst estimates don’t signal a significant rise in 2024.8

The enduring attraction of illiquidity premium

Given their strong capital and liquidity positions, European life insurers remain well placed to further allocate to illiquid credit, such as middle-market direct lending and high-quality, long-dated real estate debt. We expect the search for illiquidity premium to be particularly intense in the booming pension risk transfer markets in the UK and potentially in the Netherlands.

Alongside private credit, we continue to see pockets of opportunity in real estate. The headlines were gloomy for the property market in 2023, with crumbling valuations and transaction volumes at half the average of the last six years. However, looking beyond the headlines, we have seen opportunities in individual segments and regions, such as self-storage and logistics in Spain and Italy. We have also seen UK life insurers continue to source deals in commercial property equity and debt, including long-dated real estate loans for their ever-growing matching-adjustment portfolios. With insurers’ property portfolios heavily biased toward their home markets and in-house origination, we favor a more pan-European approach to property investing in 2024, with in-house core capabilities complemented by those of specialist external managers.

APAC: The search for stable income will likely intensify amid shifting regulations

In 2023, the tidal pull of new capital regulations and accounting standards, fluctuating interest rates, and volatile currency hedging costs continued to reshape the APAC insurance industry. Like their European counterparts, many Asian insurers adopted the IFRS 17 standard on 1 January 2023.9 Unlike their European peers, who have been operating under Solvency II regulations since 2016, for many APAC insurers the new accounting standards are being introduced alongside new risk-based capital regulations.10 When fully implemented, we expect these changes to have a profound long-term impact on APAC insurers’ product mix, asset-liability management, and investment strategy.

Over the past 18 months, the introduction of capital requirements for interest rate risk, coupled with the rise in local long-term bond yields, has led to a rotation from overseas into domestic fixed income (typically, long-dated government debt), especially in markets such as Japan and South Korea.11 We expect this trend to continue through 2024.

The shift to a more market-consistent accounting valuation of insurers’ assets and liabilities is likely to encourage the replacement of volatile listed equities with stable-value private market assets, with private credit generally looking more attractive than both private equity and real estate equity based on return on regulatory capital. High-quality floating-rate assets, such as investment grade CLO tranches, can provide a source of spread return as well as some diversification from long-dated local government bonds.

For life insurers writing US dollar-denominated policies, balance sheet efficiency could be further boosted by capital-efficient active security selection – whether for in more tightly constrained matching-adjustment bond portfolios of Singapore and Hong Kong life insurers or in insurers’ liability-backing buy-and-maintain fixed income allocations across the region – while pursuing opportunities in high-quality, long-duration income-producing private credit.

Global specialty (re)insurance: building resilience through diversification

2023 was a year of high natural catastrophe losses, with $250 billion in overall damage and insured losses exceeding $90 billion. Severe storms, particularly in North America and Europe, caused unprecedented total losses of $76 billion, with $58 billion insured.12 While the earthquakes in Syria and southeast Turkey in February and Typhoon Doksuri in the South China Sea region in July were among the most destructive catastrophes of the year, their impact on the insurance industry’s financials was negligible, highlighting the economic and human cost of the protection gap in these regions. Record-breaking temperatures fueled extreme weather events and wildfires around the world throughout the year.

Against this backdrop, listed European reinsurers reported strong business performance in their 2023 third-quarter updates, driven by solid underwriting and higher investment returns. Reinsurance pricing remained robust in the January 2024 renewals despite expanding market capacity, with global property catastrophe rates increasing by a modest 3%, compared with 37% a year earlier.13

Optimizing the risk mix

The combined challenge of subdued reinsurance rate growth, persistent cost inflation, and the increasing incidence and severity of extreme weather losses is putting more pressure on reinsurers’ investments as a driver of business performance. The strength of global reinsurers lies in their ability to mix and diversify risks. A judicious balance between underwriting and investment risks, as well as broader diversification of investment risks across credit, illiquidity, complexity, and geographic risks, could deliver stronger results without compromising portfolio resilience. For more traditional reinsurers that are largely (or entirely) invested in high-quality liquid fixed income, an incremental exposure to equity risk in the form of an actively managed listed equity strategy could provide a source of uncorrelated return and tail risk diversification without giving up on liquidity.

What would a globally diversified reinsurance investment strategy look like in 2024? Given the ongoing macroeconomic uncertainty, we favor fixed income investments that offer illiquidity and structuring premia rather than credit risk. These may include high-quality private debt and – when not straitjacketed by the Solvency II standard formula – CLO tranches. Leveraged finance portfolios with a defensive and diversified risk profile could also be well positioned. Additionally, we see opportunities in dollar-denominated emerging market corporate debt as the EM-DM growth differential persists in 2024.

Compared to their primary insurance clients, reinsurers have greater flexibility to allocate their capital and investments across multiple jurisdictions. This flexibility comes with the complexity of navigating multiple sets of regulations, risk-based capital regimes, accounting standards, and rating agency capital models.

Global life reinsurance: PE-backed (re)insurers are under the microscope

2023 was a mixed bag for PE-backed life (re)insurers. On the one hand, the industry has enjoyed strong deal flow and can confidently look forward to robust demand in 2024 and beyond. On the other hand, it could become a victim of its own success as regulators and rating agencies focus on the emerging risks posed by the complexity of cross-border funded reinsurance and the uncertain valuations of the opaque private assets backing these transactions.

Robust growth and strong outlook

Looking globally, in the US, several marquee transactions broke through the $10 billion threshold in 2023.14 In the UK, record pension buyout volumes have attracted new players.15 In the Netherlands, the implementation of a pension reform has put €1.4 trillion of defined benefit (DB) corporate pension schemes on track for conversion to defined contribution (DC) by 2028, providing a significant boost to the Dutch pension risk transfer market.16 In APAC, domestic life insurers have sought to move the more capital-intensive liabilities off their balance sheets in response to regulatory and accounting changes that are reshaping the sector, with PE-backed global (re)insurers stepping in to meet the demand17 and a growing allocation of reinsurance capital to Asia.18 To help support their ambitions, PE-backed reinsurers continued to secure new capital.19

Regulators scrutinize opaque and illiquid assets

PE-owned insurers have been on regulators’ radar for some time.20 However, it was not until the end of 2023 that asset-intensive cross-border reinsurance, underpinned by increasing allocations to illiquid investments, found itself in the crosshairs of international bodies,21 industry regulators,22 and rating agencies.23 We have noted increasingly vocal concerns about valuation uncertainty, illiquidity, hidden leverage, credit risk, and insufficient separation between affiliated entities, along with calls for greater consistency in national regulations24 and a call for “intrusive supervisory review of insurers’ valuation processes, and liquidity stress-testing” from the IMF.25 We do not see these concerns as pervasive across the industry, but more so concentrated in certain subsets of the market or companies.

We believe that life insurers are generally well equipped to shoulder illiquidity and complexity risks. While higher bond yields are making illiquid alternatives lose some of their luster, insurers’ strong capital and predictable liabilities position them to fill the gap left by pension fund de-risking and by banks’ retrenchment from lending, and to continue to capture illiquidity and complexity premia by providing long-term funding for productive uses. At the same time, increasing scrutiny is demanding more transparency and stronger governance of insurers’ more complex investments. We believe that insurers can create long-term value for both policyholders and shareholders by combining the respective strengths of affiliated and independent specialist asset managers in the structuring and execution of insurance solutions and by seeking consistency between the regulatory form and economic substance of their investments.

For more investing insights, see our 2024 Global Investment Outlook.

Footnotes

1 Just Group (18 January 2023) Business Update for the Year Ended 31 December 2023

2 E.g. Aviva (16 August 2023) Q1 2023 Trading Update; Legal & General Group (11 August 2023) 2023 Half Year Results; Hannover Re (9 August 2023) Half-Year Financial Report 2023; a.s.r. (30 August 2023) 2023 Half-year results

3 Reuters (11 January 2023) British motor insurers slide as Direct Line axes dividend

4 Moody’s (7 December 2023) Global P&C insurance outlook negative as claims inflation, natural catastrophes constrain profits

5 EIOPA Insurance Statistics – Group Quarterly Balance Sheet (accessed 18 January 2024). 2023 Q1 is the latest available datapoint as of the time of writing.

6 S&P Global Ratings (21 November 2023) EMEA Insurance Outlook 2024: Navigating the Way Home

7 DBRS (29 November 2023) 2024 Italian Insurance Outlook: Improving Trends in the Life Business and Resilience in Nonlife

8 S&P Global Ratings (21 November 2023) EMEA Insurance Outlook 2024: Navigating the Way Home

9 On 1 January 2023, IFRS 17 has become effective for dual-listed insurers in China, multi-national life insurers in Hong Kong, as well as for Malaysian and Korean insurers. For Korean insurers, IFRS 17 was introduced jointly with IFRS 9. While adoption of IFRS is voluntary for Japanese insurers, it will affect foreign-owned insurance entities with group headquarters located in jurisdictions with compulsory IFRS implementation.

10 In Korea, the new risk-based Korea Insurance Capital Standard (K-ICS) commenced from January 2023. Similar ICS-based regulations are slated for implementation in Japan (in FY2025) and in Taiwan (in FY2026, with a 15-year transition period). Hong Kong enacted its new risk-based capital regime (RBC) on 6 July 2023, effective for FY2024; several large insurers opted for earlier adoption.

11 Japanese insurers divested over ¥12tn (>US$80bn) from foreign securities (including, but not limited to, fixed-income securities) in 2022 Q3 to 2023 Q3, reversing the ¥12tn flow into foreign securities over the course of 2018-2021. Source: Bank of Japan Flow of Funds Statistics accessed 15 January 2024, PineBridge Investments interpretation.

12 Munich Re (9 January 2024) Record thunderstorm losses and deadly earthquakes: the natural disasters of 2023

13 Artemis (3 January 20232023) Renewals: Catastrophe retro rates +50%, global property cat +37%, says Howden; Artemis (2 January 2024) Property cat rates up 3%, retrocession flat at January 2024 renewals: Howden

14 Manulife (11 December 2023) Manulife announces $13 billion reinsurance deal, including $6 billion of long-term care, with Global Atlantic; Fortitude Re (2 May 2023) Fortitude Re Announces $28 Billion Life & Annuity Reinsurance Agreement with Lincoln Financial Group

15 M&G (20 September 2023) M&G re-enters the bulk purchase annuity market with two buy-in transactions totalling £617m; Resolution Life (30 October 2023) Resolution Re announces first UK PRT reinsurance transaction; Resolution Life (15 January 2024) Resolution Re announces new reinsurance transaction in the UK

16 Fitch (9 June 2023) Dutch Pension Reform a Growth Opportunity for Life Insurers

17 Kuvare (27 February 2023) Kuvare Expands Internationally With Three New Reinsurance Transactions; Athene (27 November 2023) Athene Executes Block Reinsurance Transaction in Japan

18 Guy Carpenter (May 2023) Dedicated Reinsurance Capital for Asia Life Business

19 Resolution Life (24 January 2023) Nippon Life to commit further $1 billion in Resolution Life; Athene (9 February 2023) Athene Announces $2 Billion First Close For Apollo / Athene Dedicated Investment Program II

20 International Association of Insurance Supervisors (30 November 2021) 2021 Global Insurance Market Report Section 2.5.1. Macroprudential themes: Low interest rate environment and private equity ownership; US National Association of Insurance Commissioners (13 August 2022) Regulatory Considerations Applicable to (But Not Exclusive to) Private Equity (PE) Insurers

21 International Monetary Fund (19 December 2023) Private Equity and Life Insurers

22 Bank of England (16 November 2023) Consultation paper 24/23 - Funded Reinsurance; International Association of Insurance Supervisors (6 December 2023) 2023 Global Insurance Market Report Section 3.2. Structural Shifts in The Life Insurance Sector; Bermuda Monetary Authority (18 December 2023) Supervision And Regulation Of Private Equity Insurers

23 Fitch (27 November 2023) Shift to Illiquid Assets Raises Risks for Some U.S. Life Insurers

24 EIOPA (21 December 2023) Supervisory Convergence Plan for 2024

25 International Monetary Fund (10 October 2023) Global Financial Stability Report, October 2023: Financial and Climate Policies for a High-Interest-Rate Era

Disclosure

Investing involves risk, including possible loss of principal. The information presented herein is for illustrative purposes only and should not be considered reflective of any particular security, strategy, or investment product. It represents a general assessment of the markets at a specific time and is not a guarantee of future performance results or market movement. This material does not constitute investment, financial, legal, tax, or other advice; investment research or a product of any research department; an offer to sell, or the solicitation of an offer to purchase any security or interest in a fund; or a recommendation for any investment product or strategy. PineBridge Investments is not soliciting or recommending any action based on information in this document. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of PineBridge Investments, and are only for general informational purposes as of the date indicated. Views may be based on third-party data that has not been independently verified. PineBridge Investments does not approve of or endorse any republication of this material. You are solely responsible for deciding whether any investment product or strategy is appropriate for you based upon your investment goals, financial situation and tolerance for risk.