India’s Markets Can Weather Rising US Tariffs. Here’s Why.

Huzaifa Husain

Head of India Equities

Priyasha Mohanty

Equity Product Specialist

US President Donald Trump announced a 25% tariff on goods imported from India, effective 1 August, along with an additional penalty of 25% (scheduled to kick in from 27 August) related to India’s ongoing energy and defense trade with Russia. US officials are scheduled to visit India to discuss a trade deal from August 25-30. India is expected to maintain its firm stance on agricultural and dairy market access, considering them non-negotiable, and is likely to negotiate for exemptions or phased tariff reductions.

Not surprisingly, the tariff announcements have raised speculation about the potential impact on India’s economy, corporate sector, and financial markets.

To put the situation into perspective, the US recorded a trade deficit of US$45.5 billion with India in 2024. US goods exports to India totaled US$41.5 billion, while imports from India reached US$87.3 billion.1 Notably, exports to the US accounted for 17% of India’s total exports and approximately 2.2% of its GDP. Without a resolution, key Indian export sectors – such as gems and jewelry, textiles, auto parts, and chemicals – could face immediate headwinds.

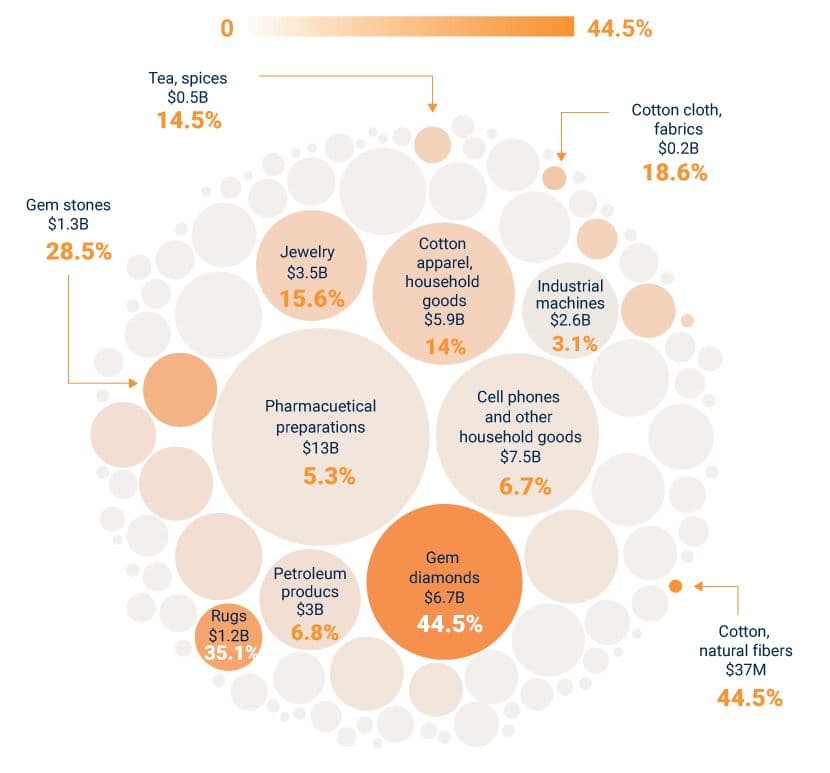

Assessment of key export sectors

Here we provide our initial assessment of key sectors that are most directly connected to exports to the US:

Pharmaceuticals. Currently exempt from the new tariffs, the pharmaceutical sector remains a critical component of US imports from India, valued at approximately US$13 billion in 2024. Given the US’s reliance on affordable Indian generics, particularly in essential medicines, this sector is unlikely to face significant tariff-related disruptions. Moreover, many Indian pharmaceutical firms have been establishing manufacturing facilities in the US, offering a degree of insulation against supply chain disruptions and trade barriers.

It is also worth noting that India is the country with the largest number of US FDA-compliant plants outside of the US – more than 262, including those producing active pharmaceutical ingredients (APIs). The Indian pharmaceutical industry has witnessed robust growth over the past few years, with exports destined to more than 200 countries, including the highly regulated US, West Europe, Japan, and Australia markets.2

Cotton apparel. India holds a 14% share of US imports in this category. However, with the US imposing tariffs of 20% on Bangladesh exports and similar rates on Indonesia, Vietnam, and Cambodia,3 India’s competitiveness could be at risk if it fails to secure tariff relief in the final agreement.

Electronics. Electronics exports, led by smartphones (notably iPhones), are currently exempt from tariffs. The final impact will depend on the broader trade framework, including how the US treats imports from other major electronics exporters, like China.

Gems and jewelry. India commands a dominant 44.5% share of US imports in this segment. Given the US’s dependence on Indian suppliers, shifting supply chains would be costly and disruptive. Also, the gems and jewelry sector is labor and skill intensive and therefore price insensitive. While tariffs may compress margins in lower-value segments, core exports – particularly diamonds and handcrafted gold jewelry – are expected to remain resilient.

Major Items US Imports from India

India's share of total US item imports

Source: Bloomberg, US Census Bureau, data as of 2024

A limited impact on India’s broader economy

In our view, the broader impact of the tariffs on India’s economy appears contained, supported by several structural strengths:

As a net importer, India can adjust its sourcing strategies to reduce its trade surplus with the US, potentially gaining leverage in future negotiations.

India’s total exports reached a record US$824.9 billion in FY2024-2025, with services exports at US$387.5 billion and merchandise exports (excluding petroleum) rising to US$374.1 billion.4

Over the past two decades, India has significantly diversified its export base, in terms of both product categories and destination markets, which has enhanced its resilience against country-specific trade shocks. For instance, India is now a leading exporter of iron and steel alloys, a market it didn’t explore until 1994. It also exported US$16.6 million of optical items between April and November 2024, tapping 14 new export markets. India’s diverse exports also include cranes, lifts, and winches, which totaled US$23.1 million over the same period and reached 12 new markets; office equipment, with an export value of US$10.7 million (and 12 new markets); and medical-scientific instruments, at US$62.7 million in exports (and nine new markets).5

India’s Diverse Exports Have Reached New Highs

India's Total Exports Value (in US$ Billion)

Source: Ministry of Commerce & Industry. https://www.pib.gov.in/PressReleasePage.aspx?PRID=2126119

The macroeconomic backdrop remains strong

India continues to be one of the fastest-growing major economies globally. According to the International Monetary Fund, India is projected to grow at 6.4% in 2025, compared to 3.0% for global output and 4.1% for emerging markets.6

Supporting this growth is a favorable macroeconomic environment, including low inflation, which provides the Reserve Bank of India (RBI) with flexibility to deploy policy tools as needed. The RBI has adopted a supportive stance, easing regulations and lowering interest rates.

India’s external position also remains robust. Foreign exchange reserves stood at US$640.3 billion as of December 2024, covering nearly 90% of the country’s external debt.

On the corporate level, as highlighted in our 2025 midyear outlook, Indian equities have demonstrated strong value creation in the post-Covid era. Over the past few years, India’s corporate sector has seen substantial growth in market capitalization, profits, and capital expenditures, despite periods of volatility. Our proprietary data analysis shows continued momentum in profits and capex, with companies actively investing to meet both domestic and global demand. Favorable monetary conditions, solid corporate fundamentals, and lower commodity prices are expected to support further investment and margin expansion. We do not expect the trade developments to derail this long-term trend.

Domestic investors continue to drive the majority of market flows, with resilience evident in local participation. However, foreign investors may adopt a more cautious stance toward Indian equities in the near term, reacting to tariff-related uncertainties. Combined with the relatively rich valuations of Indian equity markets, this could lead to some pressure on short-term foreign inflows.

While the final US-India trade deal remains under negotiation, its full impact on the economy and the equity market has yet to be determined. We will continue to monitor developments closely.

An energy revolution in India

A key development to watch is whether India will stop importing oil from Russia – an outcome we view as possible, given that the discount for Russian crude has narrowed and the benefit is no longer as meaningful to India.

In fact, India has made remarkable progress in the renewable energy sector. As of June 2025, the country had achieved 235.7 GW from non-fossil-fuel sources, comprising 226.9 GW of renewable energy and 8.8 GW of nuclear power, accounting for 49% of the country’s total installed power generation capacity of 476 GW. As per International Renewable Energy Agency Statistics 2025, India ranks fourth globally in renewable energy installed capacity, fourth in wind power, and third in solar power capacity.

A quiet yet transformative shift is underway in India’s energy landscape – one that could dramatically reduce the country’s reliance on imported fuels and chart a course toward sustainable, self-reliant growth. This shift was signaled by a recent auction for the procurement of green ammonia, produced using green hydrogen. The outcome was striking: the discovered price was half that of the previous auction and nearly on par with gray ammonia, which is derived from fossil fuels.

This pricing breakthrough is possible only because green hydrogen – the key input – is now expected to be produced at a cost far lower than previously anticipated. In fact, back-calculations from the auction suggest that India has achieved a green hydrogen price that wasn’t expected until 2030.

The implications are profound. Green hydrogen has the potential to eliminate India’s dependence on imported fossil fuels, thereby addressing its trade deficit and enhancing energy security. Green hydrogen is expected to replace many of the fossil fuels that still make up a significant share of current global energy consumption. It also plays a critical role as a feedstock in fertilizers such as urea, derived from ammonia, which is vital for ensuring food security. Until now, the missing link in this transition was the ability to produce hydrogen from renewable sources at an economical price. That link has now been forged.

India has reached this technical milestone ahead of any other country, positioning itself as a global leader in the green energy transition.

Our positioning holds firm

Given that the most significant exports from India – technology, pharmaceuticals, and electronics such as smartphones – are exempt from tariffs, their impact will be felt mainly in labor-intensive industries like polished diamonds and textiles. If trade negotiations between the US and India force a choice between safeguarding India’s labor-intensive exports and curbing imports from Russia, we believe India is more likely to opt for the latter. The country still has until the end of the month to decide on the next step and is also awaiting the outcome of the Russia-Ukraine peace talks.

We remain confident in our current positioning and do not anticipate material disruptions from the recent tariff measures. Our positive stance on Indian banks is unchanged, given their attractive growth and valuation metrics. While we do not expect a direct impact on India’s banking sector, we will monitor potential effects on parameters such as corporate earnings, capital expenditure, and loan growth.

We maintain a strategic focus on companies with strong domestic exposure and reasonable valuations. For export-oriented firms, we believe the ability to establish local operations in key markets will be a critical differentiator.

1 Source: Office of the United States Trade Representative. https://ustr.gov/countries-regions/south-central-asia/india

2 Source: Department of Pharmaceuticals. https://pharma-dept.gov.in/pharma-industry-promotion

3 Source: The White House. https://www.whitehouse.gov/presidential-actions/2025/07/further-modifying-the-reciprocal-tariff-rates/

4 Source: Ministry of Commerce & Industry, 2 May 2025. https://www.pib.gov.in/PressReleasePage.aspx?PRID=2126119

5 Source for export data: Economic Survey of India, 2025.

6 Source: International Monetary Fund, World Economic Outlook Update, July 2025. https://www.imf.org/en/Publications/WEO/Issues/2025/07/29/world-economic-outlook-update-july-2025

Disclosure

Investing involves risk, including possible loss of principal. The information presented herein is for illustrative purposes only and should not be considered reflective of any particular security, strategy, or investment product. It represents a general assessment of the markets at a specific time and is not a guarantee of future performance results or market movement. This material does not constitute investment, financial, legal, tax, or other advice; investment research or a product of any research department; an offer to sell, or the solicitation of an offer to purchase any security or interest in a fund; or a recommendation for any investment product or strategy. PineBridge Investments is not soliciting or recommending any action based on information in this document. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of PineBridge Investments, and are only for general informational purposes as of the date indicated. Views may be based on third-party data that has not been independently verified. PineBridge Investments does not approve of or endorse any republication of this material. You are solely responsible for deciding whether any investment product or strategy is appropriate for you based upon your investment goals, financial situation and tolerance for risk.