Leveraged Finance Asset Allocation Insights: Watching for Dips

Steven Oh, CFA

Co-Head of Leveraged Finance

John Yovanovic, CFA

Co-Head of Leveraged Finance

Kevin Wolfson

Portfolio Manager, US Leveraged Loans and CLO Management

Laila Kollmorgen, CFA

Global Head of CLO Tranche Investments, Portfolio Manager

Jeremy H. Burton, CFA

Portfolio Manager, US High Yield and Leveraged Loans

Andrew Karlsberg, CFA

Portfolio Risk Manager and Investment Strategist, Leveraged Finance

Jonathan Kramer, CFA

Fixed Income Product Specialist, Leveraged Finance

Evan Burke

Assistant Portfolio Manager, US Leveraged Loans

Komal Shahzad, CFA

CLO Tranche Analyst

Moderated economic growth in the near term could pressure leveraged finance issuer fundamentals, though leverage and other credit metrics are starting from a point of relative strength. The most recent earnings season has also been positive overall for issuers, though dispersion at the sector level has been quite sharp.

Overall, we expect positive, carry-based total returns for high yield bonds (but muted excess returns) and believe defaults could bleed a bit higher in 2026. We maintain a neutral portfolio stance following recent spread tightening and currently favor BB/B rated segments over lower-quality segments.

For leveraged loans, current economic conditions will likely spur volatility that skews toward weaker credit profiles, as well as sectors facing broader economic headwinds, such as autos and chemicals, and credits exposed to AI thematics. However, healthy fundamentals and limited maturities over the next two years should limit distress within the broader loan market.

We believe CLOs have attractive total return potential relative to other equivalently rated fixed income assets amid current conditions, and the technical picture appears supportive given strong ETF and institutional demand and high redemption and amortization volumes. While risks seem balanced, tight valuations tilt us toward an incrementally more defensive portfolio bias.

The most recent earnings season has been positive overall for leveraged finance issuers, though dispersion at the sector level has been quite sharp. On the positive side, energy and retail companies have beaten low expectations, and we’ve seen more instances of companies raising than lowering guidance. On the other hand, the chemicals sector faces headwinds from weak global demand and significant overcapacity.

We have seen brief periods of spread widening in each of the past two months. The first came on the back of two prominent auto sector bankruptcies, along with commercial mortgage fraud at two regional banks. These events sparked renewed debate over credit market vulnerability, with the analogy that “there is rarely just one cockroach” underpinning concerns that these failures might presage a broader negative credit cycle. However, current evidence suggests that these incidents remain largely idiosyncratic, but with the risk that they may reflect other facets of today’s K-shaped economy.

A second episode of spread widening came in November, as skepticism over an AI bubble and doubts about hyperscalers’ ability to recover their AI investments weighed on sentiment. Investors questioned whether the rapid pace of AI infrastructure investment can be sustained until both the infrastructure and downstream applications deliver meaningful, scalable revenue. Nonetheless, spreads eventually tightened following both instances amid renewed expectations of Fed cuts and supportive technical conditions.

While economic growth remained robust in the third quarter, almost no new jobs were created. Entry-level jobs in particular seem to be bearing the brunt of this flatlining in new job formation, even as economic and income growth continue. Economic growth is expected to soften heading into year-end, though the consensus remains that the US will avoid a recession and that economic activity will reaccelerate in 2026. Moderated economic growth in the near term could pressure issuer fundamentals, though leverage and other credit metrics are starting from a point of relative strength. Also, any downside surprises in economic activity could spur further Fed rate cuts, providing relief for issuers with floating-rate debt in their capital structures.

Given recent spread tightening, portfolios are moderately positioned in terms of overall beta risk, and we instead favor adding incremental value via issuer and security selection. We continue to find attractive opportunities in both the bank loan and high yield markets, despite viewing both as fairly valued at the overall asset class level. While we believe total return potential for collateralized loan obligations (CLOs) looks attractive relative to similarly rated fixed income assets, tight valuations tilt us toward an incrementally more defensive portfolio bias.

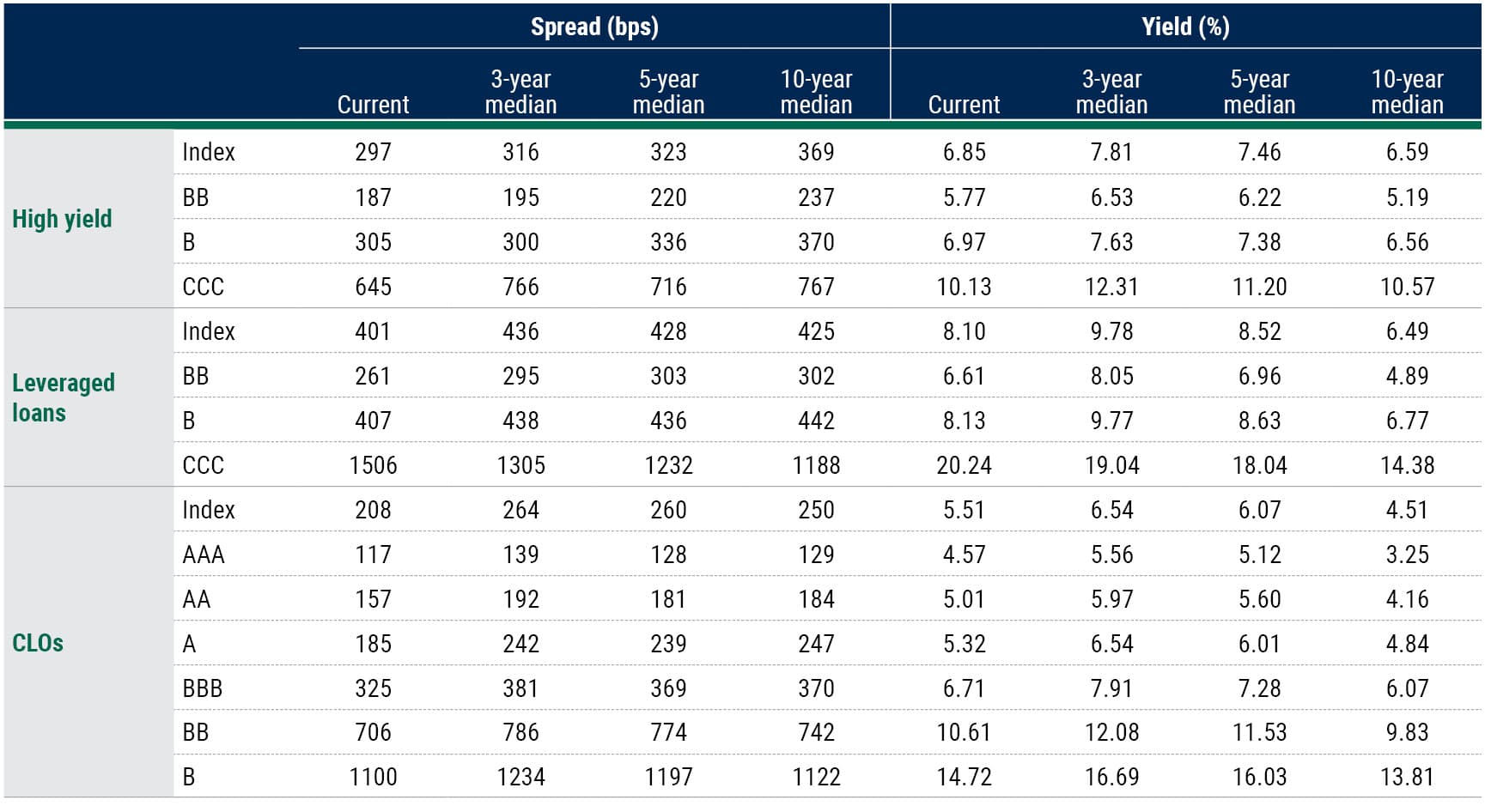

Key Data

Source: Bloomberg as of 24 November 2025. High yield represented by the Bloomberg US Corporate High Yield Index; spread is OAS and yield is yield-to-worst. Leveraged loans represented by the Morningstar LSTA Leveraged Loan Index; spread is spread-to-maturity and yield is yield-to-maturity. CLOs represented by the JPM Post-Crisis CLOIE; spread is discount margin to worst and yield is yield-to-worst. Methodologies used differ between asset classes to account for differences in characteristics, including, but not limited to, call protection, reference rate, cash flows, coupon rates, and embedded options.

High Yield Bonds

Overall, we expect positive, carry-based total returns for high yield bonds (but muted excess returns) and believe defaults could bleed a bit higher in 2026. We maintain a neutral portfolio stance following recent spread tightening and currently favor BB/B rated segments over lower-quality segments.

Third-quarter earnings results and guidance were positive overall, and leverage/coverage ratios remain at longer-term median levels. Fundamentals are still supportive, and the default backdrop remains benign. The last-12-month (LTM) par-weighted default rate increased in November but remains relatively low at 1.82%, including distressed exchanges.1 The par-weighted upgrade/downgrade ratio remains supportive year to date, with 256 upgrades totaling $424 billion, exceeding the 250 downgrades totaling $348 billion in the same period.2

High yield new issuance remains strong, with $25 billion in bonds printed in November, up from $18 billion in October and close to the year-to-date monthly average of $29 billion. Issuance continued to skew up in quality, with 64% in the BBs and 36% in single-Bs.3 CCC issuance remains challenged, accounting for just 3% of 2025 supply, on pace for the lowest share in more than two decades.4 Topical idiosyncratic credit issues, along with the potential for liability management exercises (LMEs), seem to have weighed on new-issue investor appetite for the lowest-rated segment of the high yield market.

High yield spreads are again firmly inside of 300 basis points (bps).5 Investor reticence to buy “story” credits along with some equity volatility pushed spreads modestly wide of this threshold in two brief instances so far in the fourth quarter. However, on both occasions, once sentiment improved, strong demand returned and drove spreads tighter.

At current spread levels, the market is pricing in two scenarios: either a continuation of growth or a modest slowdown combined with more expansionary monetary policy. While high yield spreads are relatively tight, yields are still attractive. Given higher Treasury rates, spreads are a smaller component of all-in yields for the high yield bond asset class than they were for much of the period following the 2008-2009 financial crisis. We view high yield bonds as broadly at fair value today – not notably cheap, but not rich enough to justify sitting on the sidelines. In this environment, we believe the opportunity lies not in timing the entry point but in being invested, so as not to miss out on the potential for idiosyncratic issuer and security selection opportunities as they arise.

The Percentage of CCC Issuance Is at Its Lowest Level in 24 Years

While capital market activity remains robust overall, the market is effectively closed to most CCC rated issuers.

Source: Bank of America as of 30 November 2025. Represents the par amount of CCC issuance as a percentage of total issuance for the USD-denominated developed market high yield market.

Leveraged Loans

Current economic conditions will likely contribute to volatility that skews toward weaker credit profiles, as well as sectors facing broader economic headwinds, such as autos and chemicals, and credits exposed to AI thematics. However, healthy fundamentals and limited maturities over the next two years should limit distress within the broader loan market.

Moderating near-term economic growth could put pressure on loan issuer fundamentals, though leverage and other credit metrics are starting on a healthy footing after multiple quarters of stable revenue and earnings growth, as well as several Fed rate cuts. In addition, any downside surprises in economic activity versus current forecasts would most likely justify further rate cuts, providing direct relief for issuer fundamentals. Lender-friendly capital markets have broadened access in recent months and allowed performing credits rated B-/B3 to refinance near-term debt, and we’ve seen a handful of weaker credits refinance their broadly syndicated loans through the private credit market. As a result, the percentage of the loan market maturing over the next two years is limited and should help curtail the number of traditional payment defaults over the medium term.

Technicals should remain supportive of loan prices, with stable demand from CLOs coupled with limited net loan supply. CLO issuance growth should stay measured and lean toward opportunistic transactions while the equity arbitrage economics remains challenged, even with relatively stable AAA liability spreads. In terms of loan supply, current conditions will likely persist through year-end amid the overhang of uncertainty following the government data blackout and bouts of volatility, mostly driven by trade policy or concerns over the AI trade; however, the loan market currently has limited direct exposure to the latter. In the absence of material net new-money transactions tied to leveraged buyouts and M&A, we can expect new issuance to be concentrated in opportunistic transactions heading into the traditionally slower holiday season.

Loans Face Limited Near-Term Maturities Amid Accommodative Capital Markets

Source: Pitchbook as of 30 November 2025.

Distressed Transaction Activity Is Trending Lower

Source: Pitchbook as of 30 November 2025.

CLOs

We believe CLOs have attractive total return potential relative to other equivalently rated fixed income assets amid current conditions. Despite record-setting issuance, the technical picture appears supportive given strong ETF and institutional demand and high redemption and amortization volumes. While risks seem balanced, we expect to see bouts of volatility in the coming months, and tight valuations tilt us toward an incrementally more defensive portfolio bias.

Despite recent softness, CLO spreads remain near SOFR-era tights and are priced in the 25th percentile historically.6 CLO fundamentals continue to look stable, and we don’t expect to see systemic stress in loans or CLOs, but rather more idiosyncratic stories.

The technical backdrop is poised to remain supportive. Year-to-date new issue volume remains ahead of last year’s record pace, bolstered by record-setting new issuance of middle-market CLOs. However, loan repricings have put pressure on equity arbitrage, making it more challenging to bring new deals to market. Tighter liability spreads are helping offset lower asset coupons, but not entirely.

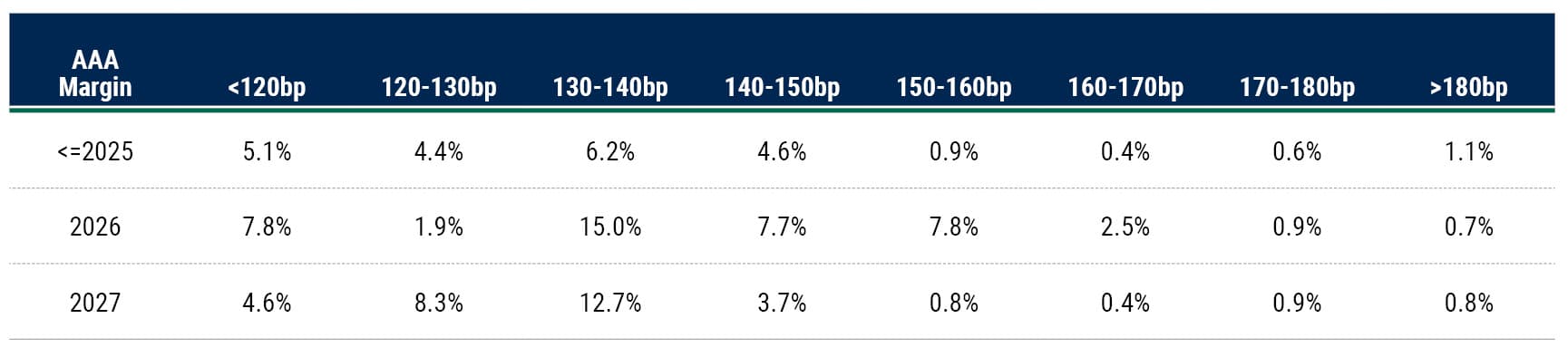

Meanwhile, US broadly syndicated loan (BSL) CLO refi/reset activity has already set an annual record with nearly a month still left to go. At current spread levels, refi/reset activity is poised to continue at a rapid pace heading into 2026. Roughly $422 billion of US CLO notional value is exiting its non-call period in 2026, $330 billion of which is in-the-money at a 130-bp AAA spread, on top of $131 billion already out of the non-call period and in the money.7 Despite record issuance, high levels of deal redemptions and amortizations have constrained net supply, resulting in growth of just $53 billion in the US BSL CLO market to date this year.8

Notwithstanding outflows from mezzanine CLO ETFs in October and November, total ETF flows continue to be positive, and CLO demand is expected to remain strong. Year-to-date, CLO ETFs have seen inflows of $15 billion, and total CLO ETF assets under management exceed $38 billion.9 Institutional demand, particularly from insurance companies and US and Japanese banks, is also expected to remain strong despite anticipated Fed rate cuts.

While we don’t expect significant spread compression from here, we believe returns will be driven by carry going forward. We think CLOs have attractive total return potential relative to other equivalently rated fixed income assets under these conditions. That said, roller-coaster trade dynamics and other currents will keep markets fluid, and we expect to see both positive shocks, in the form of deal announcements or teases, and negative ones, such as more aggressive policies or deal disappointments. Despite likely headline-driven volatility in the coming months, we believe the risk is balanced. Nonetheless, tight valuations tilt incrementally toward a more defensive portfolio bias.

Significant US CLO Volumes Exit Their Non-call Periods in 2026

US CLO universe by non-call year and AAA margin

US CLO Universe By Non-call Year and AAA Margin

(% amount)

Source: J.P. Morgan, “CLO 2026 Outlook,” as of 25 November 2025.

About This Report This is a quarterly publication which encapsulates insights of PineBridge Investments’ Leveraged Finance Team. Our global team of investment professionals convenes in a live forum to evaluate, debate, and establish top-down guidance for the leveraged finance investment universe. Using our independent analysis and research, driven by our Fundamentals, Valuations, and Technicals framework, we assess the pulse of high yield, leveraged loans, and CLOs.

1 Source: JP Morgan Research as of 30 November 2025.

2 Ibid.

3 Source: Bank of America Research as of 30 November 2025.

4 Ibid.

5 Source: Bloomberg High Yield Index Option Adjusted Spread (OAS) as of 24 November 2025.

6 J.P. Morgan, “CLO 2026 Outlook,” as of 25 November 2025.

7 J.P. Morgan, “CLO 2026 Outlook,” as of 25 November 2025.

8 Barclays as of 30 November 2025.

9 BofA Global Research, Bloomberg, “CLO Factbook,” as of 24 November 2025.

Disclosure

Investing involves risk, including possible loss of principal. The information presented herein is for illustrative purposes only and should not be considered reflective of any particular security, strategy, or investment product. It represents a general assessment of the markets at a specific time and is not a guarantee of future performance results or market movement. This material does not constitute investment, financial, legal, tax, or other advice; investment research or a product of any research department; an offer to sell, or the solicitation of an offer to purchase any security or interest in a fund; or a recommendation for any investment product or strategy. PineBridge Investments is not soliciting or recommending any action based on information in this document. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of PineBridge Investments, and are only for general informational purposes as of the date indicated. Views may be based on third-party data that has not been independently verified. PineBridge Investments does not approve of or endorse any republication of this material. You are solely responsible for deciding whether any investment product or strategy is appropriate for you based upon your investment goals, financial situation and tolerance for risk.