The Case for Asia-Pacific Bonds: Debt Sustainability as a Source of Stability

Jonathan Davis

Client Portfolio Manager and Sustainable Investment Strategist – Emerging Markets Fixed Income

Omar Slim, CFA

Co-Head of Asia Fixed Income

Andy Suen, CFA, FRM

Co-Head of Asia Fixed Income

The expansion of global debt markets has introduced myriad investment opportunities and diversified the role of fixed income within portfolios, but capital preservation and income creation remain core objectives of many fixed income allocations. Despite the evolution of debt markets around the world, most core fixed income allocations rely heavily on debt issued by major government borrowers. Across many of the world’s advanced economies, budget deficits and higher interest rates have raised concerns about the sustainability of the debt that underpins many investors’ core fixed income allocations.

Most of the world’s largest economies run budget deficits, relying on consistent access to capital to continue funding government expenditures and to service debt. With the political climate in the US and Europe becoming more polarized, the prospects of meaningful budget reforms are dim. with governing coalitions likely to maintain or increase spending to consolidate popular support and fund emerging priorities, notably defense spending in Europe and other countries.

G7 Government Structural Balance as % of GDP

Source: IMF and PineBridge Investments as of 31 October 2025. For Illustrative purposes only. We are not soliciting or recommending any action based on this material. Any opinions, projections, forecasts, and forward-looking statements presented are valid only as of the date indicated and are subject to change.

Governments borrow money to fund these deficits, adding to debt levels that are already greater than GDP for most of the G7 countries. While Germany remains an exception, it is poised for a substantial increase defense and infrastructure spending. Japan’s indebtedness stands out, but Japan remains one of the world’s largest net creditor nations, funding its deficit mostly domestically: over 90% of Japanese Government Bonds (JGBs) are held by either the Bank of Japan or domestic institutions – banks, insurance companies, or pension funds – which have regulatory incentives that favor investments in JGBs.

G7 Government Debt as % of GDP

Source: IMF and PineBridge Investments as of 31 October 2025. For Illustrative purposes only. We are not soliciting or recommending any action based on this material. Any opinions, projections, forecasts, and forward-looking statements presented are valid only as of the date indicated and are subject to change.

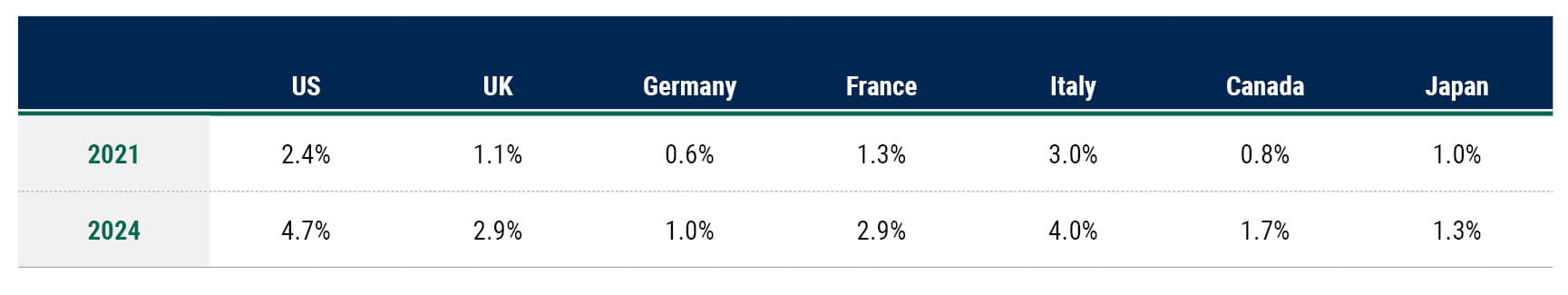

The Bank of Japan alone owns nearly 50% of outstanding JGBs – helping it control yields along the nominal curve and ensuring debt service costs remain manageable. This control was tested in 2025 and we are monitoring further government announcements to see if JGBs will be under further pressure going forward. The other central banks have much less yield curve control, with nominal yields driven by markets. Increased government spending typically leads to higher inflation expectations, and as such, deficit spending can have a compounding effect on interest expense by increasing both the cumulative amount and the cost of future borrowing. We saw this with the increase in interest expense from 2021 to year-end 2024, driven by post-Covid increases in government borrowing, higher inflation, and higher nominal bond yields.

Estimated G7 Government Interest Expense as % of GDP

Source: OECD, Financial Times and PineBridge Investments as of 31 October 2025. For Illustrative purposes only. We are not soliciting or recommending any action based on this material. Any opinions, projections, forecasts, and forward-looking statements presented are valid only as of the date indicated and are subject to change.

Expanding that regional comparison of east and west, the Asia-Pacific region features a number of large economies, with similar institutional strength and solid credit ratings . Importantly, they generally exhibit more sustainable debt dynamics. To begin with, outside of Japan, the major Asia-Pacific economies have lower gross government debt levels than their G7 counterparts.

2024 Debt to GDP Ratio: Asia-Pacific Majors and G7

Source: IMF and PineBridge Investments as of 31 October 2025. For Illustrative purposes only. We are not soliciting or recommending any action based on this material. Any opinions, projections, forecasts, and forward-looking statements presented are valid only as of the date indicated and are subject to change.

From a baseline of lower debt levels, most of the major Asia-Pacific economies run smaller budget deficits than their G7 peers.

2024 Structural Balance as % of GDP: Asia-Pacific Majors and G7

Source: IMF and PineBridge Investments as of 31 October 2025. For Illustrative purposes only. We are not soliciting or recommending any action based on this material. Any opinions, projections, forecasts, and forward-looking statements presented are valid only as of the date indicated and are subject to change.

Many of the major Asia-Pacific economies have consistently maintained current account surpluses since 1990, reducing their reliance on external financing and providing greater stability of foreign exchange reserves and currencies. By contrast, the G7 economies have consistently run current account deficits – and the divergence between Asia-Pacific and G7 countries has become even more pronounced over the past seven years, as Asia account surpluses have increased while G7 deficits have grown.

Current Account Balance as % of GDP: Asia-Pacific Majors and G7

Source: IMF and PineBridge Investments as of 31 October 2025. For Illustrative purposes only. We are not soliciting or recommending any action based on this material. Any opinions, projections, forecasts, and forward-looking statements presented are valid only as of the date indicated and are subject to change.

The characterization of Asia debt as more sustainable than G7 debt holds true for corporate borrowers as well as governments. Investment grade corporates – which represent roughly 85% of the Asia-Pacific corporate bond market – carry substantially lower leverage than their IG corporate peers in the US and Europe, with a sustained deleveraging trend for more than a decade, while US IG corporates have seen an increase in leverage during that time.

Investment Grade Corporate Net Leverage Ratios

Source: JP Morgan and PineBridge Investments as of 30 June 2025. For Illustrative purposes only. We are not soliciting or recommending any action based on this material. Any opinions, projections, forecasts, and forward-looking statements presented are valid only as of the date indicated and are subject to change.

As equity valuations advance to new highs in the face of a steady undercurrent of macroeconomic uncertainty, investors should not lose sight of the importance of core fixed income. Investors also must remain vigilant about the composition of their fixed income allocations and the concentration of risk in issuers with debt sustainability concerns. That is why we see a growing number of institutions looking toward the Asia-Pacific dollar bond market – with roughly $1.5 trillion of investable securities – to maintain stability and diversify risks within their core fixed income portfolios.

Largest Countries by Market Value and Government Debt to GDP Ratio

Source: BAML, Bloomberg, JP Morgan and PineBridge Investments as of 31 October 2025. Global Gov’t is ICE Global Government, Global Aggregate is Bloomberg Global Aggregate, Asia-Pac IG Credit is JP Morgan JACI APAC IG. For Illustrative purposes only. We are not soliciting or recommending any action based on this material. Any opinions, projections, forecasts, and forward-looking statements presented are valid only as of the date indicated and are subject to change.

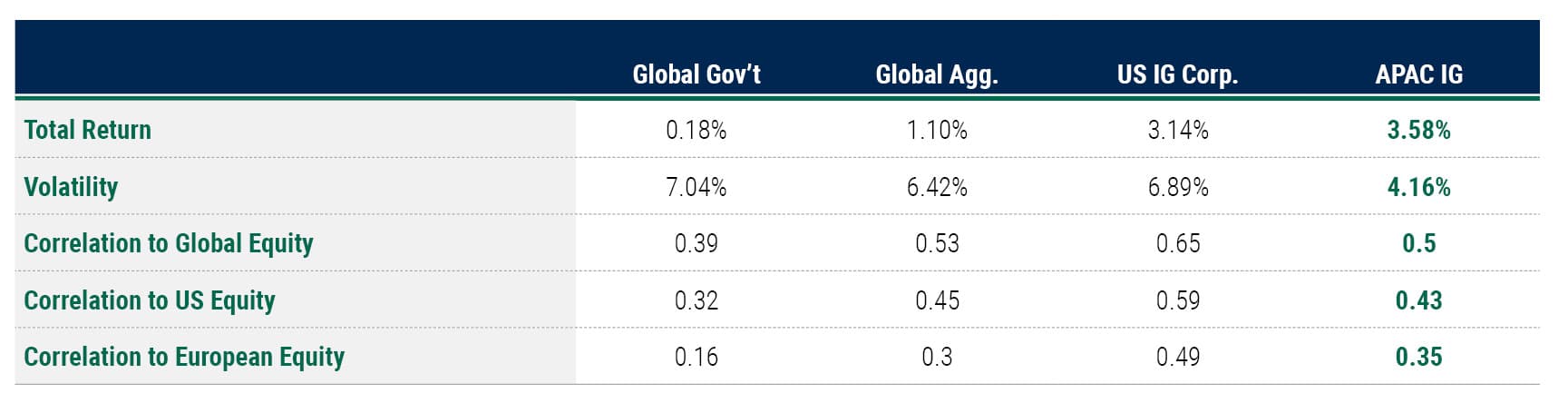

As a store of capital, the Asia-Pacific investment grade credit market has outperformed traditional core fixed income markets, with higher returns and lower volatility. It has also provided similar diversification to equity markets, proving to be an effective hedge against equity risk.

Annualized Return, Risk, and Correlation: Trailing 10 Years, USD

Source: BAML, Bloomberg, JP Morgan and PineBridge Investments as of 31 October 2025. Global Gov’t is ICE Global Government, Global Aggregate is Bloomberg Global Aggregate, US IG Corp. is Bloomberg US Corporate, Asia-Pac IG Credit is JP Morgan JACI APAC IG, Global Equity is Bloomberg World Large & Mid Cap, US Equity is S&P 500, European Equity is EURO STOXX 600. For Illustrative purposes only. We are not soliciting or recommending any action based on this material. Any opinions, projections, forecasts, and forward-looking statements presented are valid only as of the date indicated and are subject to change.

We are not forecasting a G7 debt crisis in the near term, but the escalation of debt levels does raise concerns about the long-term stability of government debt in the developed world. Investors should actively seek ways to diversify those risks within their core fixed income portfolios, and the investment grade Asia-Pacific credit market provides both the stability and downside risk protection of core fixed income staples while also diversifying debt risk within core portfolios.

Disclosure

Investing involves risk, including possible loss of principal. The information presented herein is for illustrative purposes only and should not be considered reflective of any particular security, strategy, or investment product. It represents a general assessment of the markets at a specific time and is not a guarantee of future performance results or market movement. This material does not constitute investment, financial, legal, tax, or other advice; investment research or a product of any research department; an offer to sell, or the solicitation of an offer to purchase any security or interest in a fund; or a recommendation for any investment product or strategy. PineBridge Investments is not soliciting or recommending any action based on information in this document. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of PineBridge Investments, and are only for general informational purposes as of the date indicated. Views may be based on third-party data that has not been independently verified. PineBridge Investments does not approve of or endorse any republication of this material. You are solely responsible for deciding whether any investment product or strategy is appropriate for you based upon your investment goals, financial situation and tolerance for risk.